Mortgages continue to be at the forefront of everyone’s minds right now, with increased rates and inflation making homeowners rethink their commitments, look for good advice, and find savings. Now, after UK inflation slowed by less than expected, to 8.7%, there has been a strong reaction from the financial markets.

As May came to an end, the expectation that the Bank of England would have to raise interest rates higher than previously thought grew. The Bank’s base rate – which plays a pivotal role in determining mortgage rates – rose to 5% at the end of June, the 13th consecutive increase, and could even hit 5.5% later this year.

Recently, lenders have reduced the number of deals until they have a better idea as to where money market rates are headed – almost 10% of the UK’s mortgage products have been taken off the market since 22nd May. A total of 373 residential mortgage deals have been removed and the number of buy-to-let mortgages has fallen by 405. It is hoped that this situation will ease with stability but for now, there is less choice than was the case only a few weeks ago.

For most people, the monthly mortgage is their biggest monthly outgoing. With inflation yet to ease as expected, and the headlines painting a gloomy picture, we caught up with our inhouse mortgage experts, SPF, to see what the future holds for the mortgage market.

1. Is there a mortgage ‘bill shock’ coming?

Figures indicate the more than 1.4 million fixed rate mortgage customers are facing the prospect of significant hikes to their monthly payments, when their deals come to an end this year. The ONS says that 57% of those approaching renewal in 2023 are fixed at interest rates below 2%. Now, as those coming to re-mortgage are facing drastically higher rates than this time two years ago.

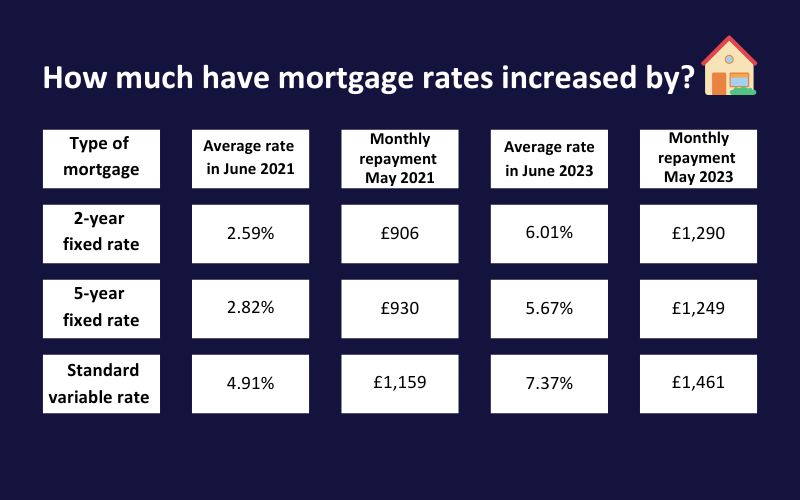

With the average two-year fixed rates now at 6.01% and five-year fixes at 5.67%* this translates into a monthly bill rise in the hundreds for many homeowners. Add this to the soaring cost of energy bills, childcare and supermarket shop, and suddenly monthly expenses are through the roof.

It’s thought the average UK household could be £2,100 worse off by the end of the next financial year with all these price increases combined!

Many borrowers are in for a mortgage shock when they come to remortgage with rates significantly higher than they were when they originally took out their deal. It will mean higher monthly payments, so borrowers will have to tighten their belts, rein in non-essential spending and dip into savings if they have them.

Mark Harris, Chief Executive at SPF explains: “While inflation has fallen, it is proving more stubborn and taking longer than forecast, which has pushed up the cost of funding. Lenders have been increasing their fixed-rate mortgages in response, pulling deals with little or no notice. Borrowers who are due to remortgage in the next few months may wish to plan ahead and secure a new deal sooner rather than later, ready to move onto once their existing product comes to an end.

“This may help reduce the payment shock if mortgage rates rise further between now and when you need to move onto a new deal. Alternatively, if lower rates are available at that time, you can apply for another mortgage – it keeps your options open and gives you some peace of mind.

“If you are coming to the end of your existing deal or are already on your reversion or standard variable rate, it may be prudent to remortgage now. The average SVR is 7.37% [according to Moneyfacts, 17 May], and with further base rate rises seemingly on the cards, this is only going to get higher. Depending on your circumstances and requirements, there are many mortgages available which are cheaper than this so you may be able to reduce your monthly mortgage payments.’

2. Bank of England raises interest rates to 5%

The Bank of England has increased the base rate by 50 basis points to 5 per cent. It is the Bank’s 13th consecutive rise and comes on the back of no move in twelve-month consumer price inflation (CPI) in May, which remained stuck at 8.7 per cent.

Seven members of the nine-strong Monetary Policy Committee voted for a 0.5 percentage points rise, while two members preferred to maintain the bank rate at 4.5 per cent.

Fixed rates are influenced by future base-rate movements and therefore not directly linked to what is decided this week. Lenders have already priced in this rate move and increased the pricing of their fixed-rate mortgages, with many borrowers coming off particularly cheap deals now facing a payment shock when they come to remortgage.

Those on base-rate trackers will find their mortgage rate increase by a further 50 basis points. A borrower with a £250,000 repayment mortgage on a 25-year term and a pay rate of 4.5 per cent will see that rise to 5 per cent, with monthly payments rising from £1,390 to £1,461.

13 successive rate rises

The cumulation of 13 successive rate rises is significant. A borrower with a £250,000 mortgage on a tracker pegged at 1 per cent over base rate will have seen their monthly payments rise from £943 in December 2021, when base rate rose from 0.1 per cent to 0.25 per cent, to £1,611 today.

With a variable-rate deal, the link between the lender’s variable rate and base-rate moves are less transparent. The lender may decide to pass on none, some, all or more than the base-rate rise.

There is plenty of concern about rising rates, particularly among those borrowers coming up to remortgage. Our advice is to plan ahead as much as possible and take action now. Rates can be booked up to six months before you need them; if rates have fallen by the time you come to remortgage, you should be able to opt for a cheaper deal.

If you don’t need to remortgage in the foreseeable future, you should still take action: pay down other debt, cut unnecessary spending and consider overpaying on your mortgage if possible to lessen the pain when the time comes.

With so much volatility in the markets, it is more important than ever that borrowers get in touch with SPF Private Clients to find out the options available to them.

3. What’s happening with stamp duty?

Stamp duty refers to the tax you pay when you buy a home in the UK, and is calculated depending on where the property is, how much you paid, and whether you own any other property/ies. In July 2020, during the Covid-19 pandemic, the Government instated a stamp duty holiday, to kickstart the property market after the pandemic put a dampener on many people’s plans to move.

In response, there was a rush from buyers, with many reconsidering where they lived in the wake of working from home requirements and other Covid restrictions. The stamp duty holiday then came to an end in June 2021, having generated activity as intended.

However, many house buyers from this period went onto two-year fixed mortgage terms, which are now about to come to an end from June 2023. And, as explained above, the new renewal rates are significantly higher and could add hundreds of pounds to their monthly repayment plan.

4. Are longer terms better right now?

With all this talk of higher mortgage rates, borrowers are having to take on longer terms in order to be able to afford their monthly repayments. While traditionally borrowers opted for 25-year terms, a record 19% of all loans taken out by first-time buyers in March were for terms of 35 years or longer, with more than half taking out a loan of more than 30 years. Moreover, the data, from trade body UK Finance, indicate that 8% of home movers are taking out mortgage terms of 35 years or more, compared with 4% in December.

It’s thought that this trend is being driven by buyers seeking to make the cost of mortgage loans more affordable on a monthly basis. But, over the lifetime of the mortgage, these homeowners will pay significantly more interest on their loans and could be burdened with debt into their retirement.

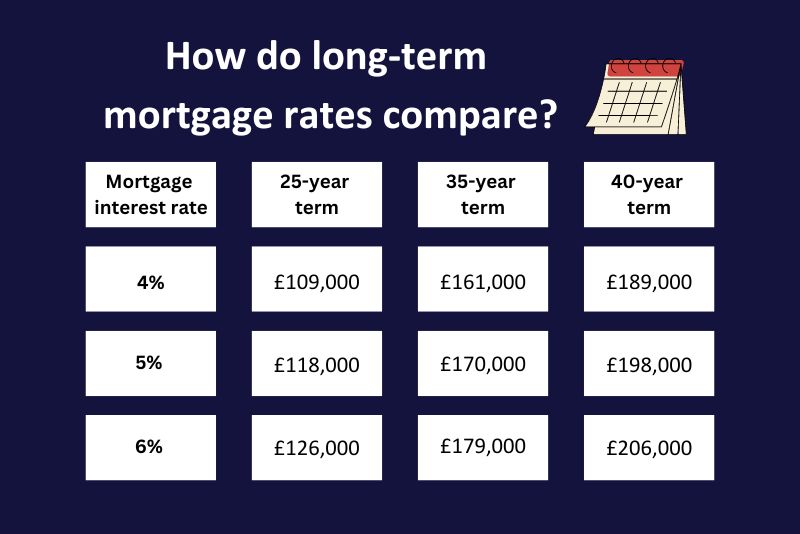

If you were to borrow a mortgage for £250,000 (the average UK property price) with a 25% deposit, here’s what you’d pay in interest over various long-term agreements:

Taking out a 6% mortgage (again, based on how much is being borrowed against the house worth £250,000) on a property at £250,000 over 40 years could cost you £206,000 in interest. The same mortgage paid over 25 years would cost you £80,000 less.

There are advantages to longer-term mortgages, however, and in some circumstances, it may be a more suitable option. For example, a longer-term mortgage could enable you to borrow more, with a smaller deposit. It could also work if you’re expecting to receive an inheritance, so you may choose to keep your monthly repayments lower for now, and then pay off the balance of your mortgage in a lump sum later on.

5. Thinking of moving?

For those in the middle of a house move, or considering moving, you may understandably be put off or anxious based on the recent market trends. But does the current situation mean you should put any plans on hold? Not necessarily.

UK house prices have been softening, falling by 1.3% over the past six months, according to Zoopla. With fewer buyers on the market, you may have an offer below asking price accepted, meaning you could get yourself your dream home for less than expected.

And for sellers too, there is reassurance in the fact that though house prices are dropping in some areas, they’re falling from a very high point. The average UK home is currently £46,000 higher than in March 2020, according to figures from Halifax.

Will the mortgage situation get any better?

Borrowers may be concerned as to the right course of action and it’s easy to get overwhelmed by all the options. Advice is more important than ever, as is planning ahead as much as possible. Rates can be reserved up to six months before you need them, depending on the lender, so if you see a rate that you like the look of, don’t hang around to secure it.

This will give you peace of mind and if, by the time you come to remortgage, rates have fallen, you should be able to opt for a cheaper product at that time. It’s also worth remembering that most lenders are giving very little notice that they are raising their rates. So, if you do find a new deal, it may not be there the next day.

Mark Harris of SPF Private Clients, says: “Your circumstances, requirements, motivations and expectations will influence what lender/product/borrowing can be had. Nobody knows what is going to happen to mortgage rates or when, or how quickly, these changes will occur.

“If you can’t afford the gamble, then a fixed rate may be the best option. Typically, options centre over two or five years. While two-year products are more expensive now than their longer-term equivalents, if you believe the outlook for mortgages will be more attractive in 18-24 months’ time, this could be an option. Alternatively, if you are expecting capital from a life event in five years’ time, you may wish to consider fixing for that period. If you only have a few years left on your mortgage term, you may want to consider fixing for that period.

“There are so many variables that borrowers should speak to an independent mortgage adviser to help sort through the minefield of products out there.”

How does working with a broker help?

If you are considering a remortgage or you haven’t remortgaged for a while, a whole-of-market mortgage broker should be your first point of call. Looking through lender websites directly and entering the same income and outgoings information over and over again can feel overwhelming and exhausting – and each lender will have different criteria so you may find a huge variation in outcomes. Brokers also often have access to some exclusive deals, which are not available if you go direct to a lender, so you increase your chances of finding the best deal for your circumstances.

Keep it simple. A mortgage broker will take all the information they need from you just the once and set about finding the right mortgage product for you while you carry on with your day. Most of this is now done online or over the telephone, while there are some brokers that are willing to visit you at home or meet in an office if preferred.

There are three different types of brokers: ones that work with a single lender, ones who work with a limited number of lenders, and whole-of-market brokers. To maximise your chances of finding the best deal, opt for a broker with access to all the lenders on the market. If they feel you will be served better by your current lender, they will tell you.

If you are self-employed, using a broker can make life a lot easier. They will know the best lenders to approach and will be able to clearly guide you through all the evidence you need to provide to proceed with your application.

Learn more about how a mortgage broker can help through SPF. Whether you choose to remortgage, stay put, or move house, your local A-Plan branch is always available to discuss any changes to your home insurance.

*accurate as of 22/06/2023, rates are changing by the day at present. Please consult SPF for the latest rates and advice.

You could also read:

Sources: SPF, BBC, The Guardian, LinkedIn, Which?, Sky News, Zoopla