Yes, you read that title right! Next month has been dubbed ‘awful April’ with seven different bills all set to rise.

While wages have been rising, so have everyday expenses, and this latest round of bill hikes could stretch our finances even further. With council services under pressure, tax thresholds frozen, and essential utilities becoming more expensive, many of us will feel the squeeze.

So what exactly is changing? Let’s run down this not so magnificent seven, and what you can do about them.

Water bills

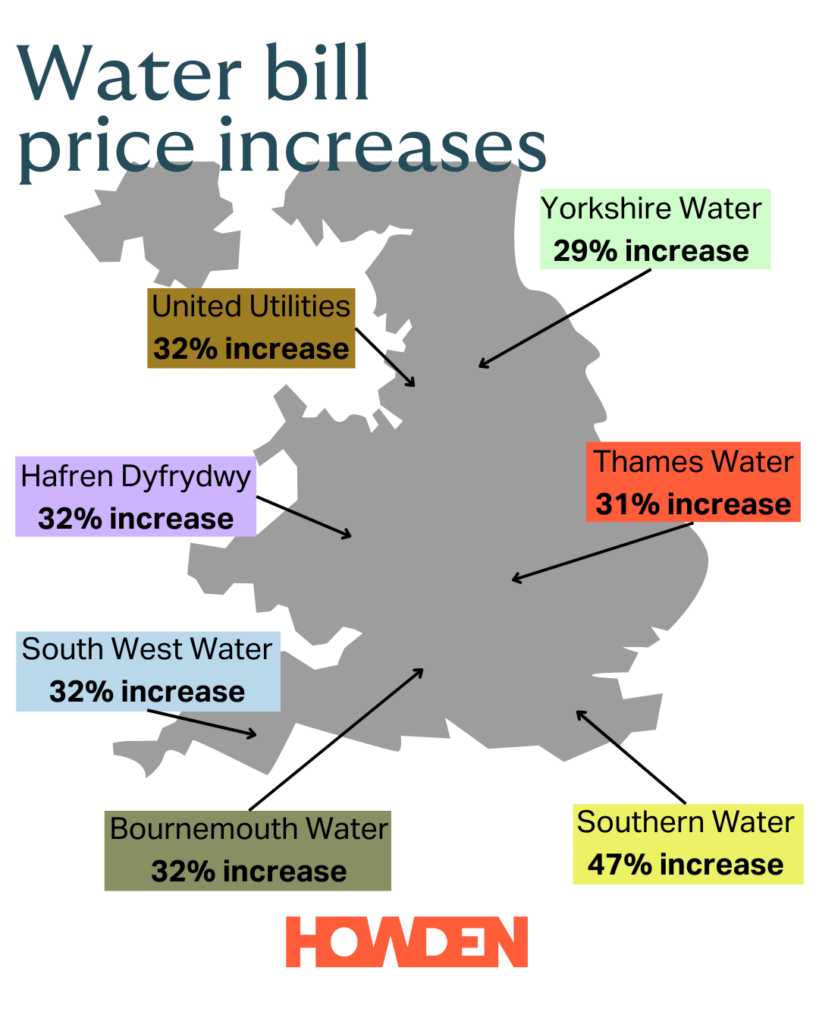

Every five years water companies propose their plans for the next half-decade, including proposed price rises and new infrastructure investments. And, as of 1 April, the average annual water and wastewater bill in England and Wales will rise from £480 to £603.

While this represents an increase of roughly £10 a month, many households will see even bigger bill increases. It all depends on where you live and who your water supplier is. But Southern Water, South West Water and Thames Water have the largest predicted price rises for 2025/6.

Check how much your water bill could be rising by here.

Energy bills

The energy price cap has once again increased. Regulated by Ofgem, it sets the maximum amount you can be charged for each unit of energy. But your actual bills depend on how much gas and electricity you use. So, with the cap set to rise by 6.4% in April, the average energy bill will go up by £111 to £1,849.

Standing charges, which are fixed fees for maintaining your connection, will also adjust, depending on your region. While some predict potential price drops in July, considering a fixed tariff now might offer more immediate stability.

Council tax

April also marks when local authorities in England could increase council tax rates. Councils responsible for social care can raise rates by up to 4.99% without requiring a local referendum, while others can implement up to a 2.99% hike.

Notably, areas like Bradford, Newham, Birmingham, Somerset, and Windsor and Maidenhead have been permitted to exceed the 4.99% cap, potentially leading to more significant increases.

To add insult to injury, several councils are considering slashing bin collections with monthly pick-ups even proposed in some places! Alarmingly, one in four councils reported to the Local Government Association that they may need emergency funding to avoid ‘bankruptcy’ at some point in the near future – a growing trend among local authorities.

Car tax (Vehicle Excise Duty)

It’s bad news if you got your car after April 2017 – your vehicle excise duty (AKA ‘car tax’ or ‘road tax’) will go from £5 to £195 for the year from April.

Another big change is that electric vehicles (EVs) will no longer be tax exempt. The standard rate will apply to EVs first registered after April 2017, while EVs registered after April 2025 will pay the lowest rate (£10).

How much you pay for your road tax will depend on when your car was registered and what type of fuel it uses.

Broadband, phone and TV license

Telecom providers are set to increase prices in line with inflation and additional charges. For example, EE mobile customers with contracts taken out after April 2024 may see a £1.50 monthly increase, while Virgin Media broadband users could experience a 7.5% rise, meaning an extra £3.50 per month for recent contracts. These may not be the biggest rises, but everything adds up when you consider the whole picture.

Additionally, the annual TV licence fee will increase by £5, reaching £174.50. If you watch live or recorded television, then you need to pay for a TV license – but if you’re only using streaming services, then you probably don’t need it. And you can pay your TV license is via direct debit, which can help spread the cost.

Stamp duty

Homebuyers in England and Northern Ireland will face changes in stamp duty thresholds. Starting in April, the duty will apply to properties over £125,000, a reduction from the previous £250,000 threshold. First-time buyers will see their exemption limit decrease from £425,000 to £300,000.

Given typical property transaction timelines, even if you start a property purchase now, it may not complete before these changes take effect.

Hidden tax rises (income tax and National Insurance)

The government has extended the freeze on income tax and National Insurance thresholds until 2028. This “stealth tax” means that as wages increase, more individuals will find themselves in higher tax brackets, effectively raising their tax contributions without altering rates.

Projections suggest that by 2028-29, nearly four million additional people will be paying income tax, with three million moving into higher tax brackets due to this policy.

It’s not all doom and gloom!

As these rising costs put extra pressure on household budgets, planning ahead has never been more important. While we can’t control energy prices or council tax hikes, we can help you protect what matters most—whether it’s your home, business, or livelihood.

Why not pop into your nearest Howden branch? Whether you need expert insurance advice, want to explore your cover options, or just fancy a coffee and a chat, we’re always happy to help! Plus, take a look at our What’s On page to see all the free events, giveaways and initiatives we’re holding across our branches.

Sources: BBC News, RAC, Uswitch

You could also read:

- Is buying a caravan worth the cost?

- The older driver’s handbook

- Is your home in a new flood hotspot?

- Dashcams and driver scores – do they reduce your premium?

- Should pavement parking be banned?

This is a marketing blog by Howden Insurance.