Uninsured driving is not just a breach of the law – it puts other road users at risk and increases the cost of insurance for all. This November, the Motor Insurers Bureau’s (MIB) annual Operation Drive Insured campaign, is bringing together police forces across the country to crack down on uninsured drivers.

With nearly 300,000 uninsured vehicles estimated to be on UK roads every day, the campaign aims to tackle this pervasive issue and highlight the serious legal and financial risks for drivers without insurance. From seizing vehicles to issuing hefty fines, police forces are ramping up enforcement efforts to protect law-abiding drivers. The stakes are high, as the penalties for uninsured driving can impact every aspect of a person’s life, from fines and driving bans to a potentially long-lasting criminal record.

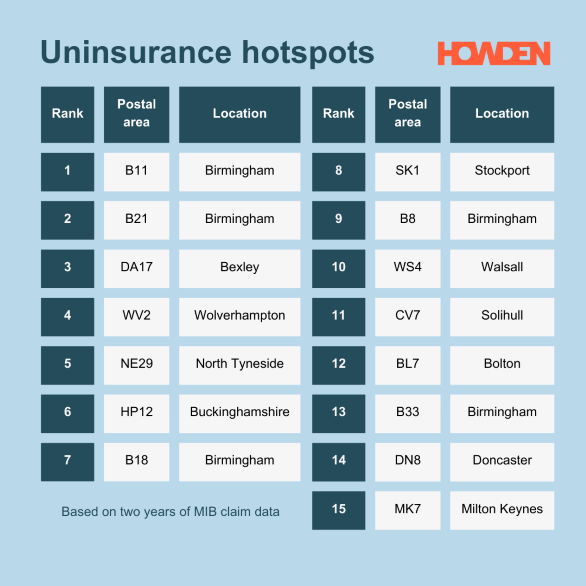

Which areas are worst for uninsured drivers?

New hotspots data from the MIB has uncovered the worst offending areas for uninsured driving across the UK, with Birmingham leading the pack. And while West Midlands postal areas account for eight of the top 15 hotspots, postcodes within Northumbria, London, Thames Valley, South Yorkshire and Greater Manchester also feature.

It’s also worth noting that there were 30 claims against uninsured drivers from Croydon submitted to MIB – the highest number in one postal district in the UK. However, because of the dense population of the area, it only ranked 176th on the hotspot list.

As part of Operation Drive Insured, road policing units across the UK are carrying out additional checks on motorists in problem areas, to try and tackle the plague of uninsured drivers. Police forces are utilising the MIB’s data, and have partnered to focus their efforts. This includes:

- Navigate, the central record of all active motor insurance policies managed by MIB.

- Operation Tutelage markers, where cars passing ANPR cameras on previous occasions have been compared to data held on Navigate. Uninsured vehicles with an Operation Tutelage marker are then flagged to police and dealt with roadside.

- Predictive Movements, to narrow down the expected movements of known uninsured vehicles.

So far this year, almost 115,000 uninsured drivers have had their vehicle seized through the work of MIB in conjunction with police. However, current estimates from MIB indicate that on average, 300,000 uninsured vehicles drive on UK roads every single day!

The serious consequences of driving uninsured

If the police stop an uninsured driver, they’ll first ask for proof of insurance. The driver will then have seven days to show documentation verifying that you had valid coverage on the day they were stopped.

If they can’t produce the necessary documents or if their insurance has expired, they’ll face penalties for driving without insurance. This could be a £300 fine and six points added to a licence. If stopped by police, the vehicle could be seized, with one in three impounded vehicles eventually destroyed. If the case goes to court, there’s a risk of facing unlimited fines and even a driving ban.

It’s important that the message is clear to uninsured drivers: getting caught without insurance impacts all areas of life. Drivers lose their independence and struggle to care for dependents (like driving children to school) to potentially hindering your job prospects by way of conviction or simply the inability to get to a job.

While many drivers who have their vehicles seized are intentionally breaking the law, it’s also important to ensure that your insurance is always valid and fit for purpose.

Top tips to ensure your insurance is valid:

- Double-check whether your policy is set to renew automatically or if you need to arrange cover for the coming year.

- Make sure your payment information and methods are up to date before your renewal date. This will stop your payment failing, and your policy not being valid.

- Don’t assume that fully comprehensive insurance lets you drive another person’s vehicle. Always check your policy, and theirs, before getting behind the wheel.

- If you’re taking a vehicle off the road, remember to declare it as SORN (Statutory Off-Road Notification). A vehicle declared as SORN can’t be parked on public land, even in your driveway where it might accidentally be hit by another car.

- Confirm that your insurance covers the specific usage type you need, like commuting or food and parcel delivery. Having the wrong class of use could leave you under, or in fact uninsured.

What to do if you’re hit by an uninsured driver?

If you’re involved in an accident where the other driver is uninsured, the claims process can become more complex, as your insurer won’t be able to recover costs from the other party’s insurance. For drivers with comprehensive coverage, your insurer may still handle the claim.

However, if you have third-party insurance, or if the driver was uninsured or fled the scene and cannot be identified, reach out to the Motor Insurers Bureau (MIB). The MIB is a non-profit organization that partners with the UK government to provide compensation to those impacted by uninsured or untraceable drivers.

Sources: Motor Insurers’ Bureau

This is a marketing blog by Howden.