We all know that buying a house today isn’t the easiest feat. Prices are high, competition is fierce, and the deposit hurdle is bigger than ever. But just how much harder is it now than it used to be?

If you bought your home in the 1980s, you might be tempted to say, “You don’t know how easy you’ve got it!” – but let’s unpack that. While house prices were lower, sky-high interest rates and house-price crashes weren’t exactly perks.

And beyond the buying struggles, there’s another lesser-talked-about issue facing homeowners today: underinsurance. With rebuild costs rising sharply, many policies might not be keeping up, leaving thousands financially vulnerable if disaster strikes. Let’s take a closer look.

Back to the future: 80s house buying vs today

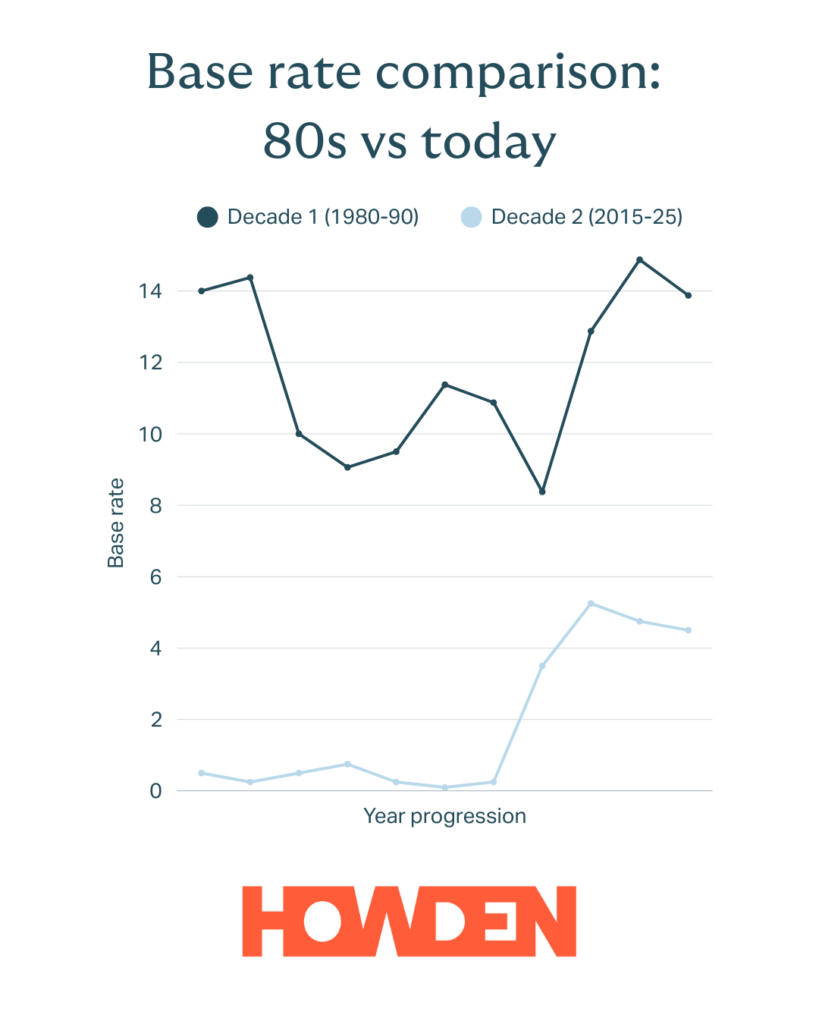

In the 1980s, buying a home came with its own set of hurdles. While the average house price in 1985 was around £34,377, interest rates were staggering. By 1989, the base rate peaked at nearly 15%! For context, today’s rates hover between 4% and 5%—still painful for first-timers, but not quite as eye-watering as the mortgage bills of yesteryear.

On the flip side, house prices today are pushing affordability to historic extremes. In 2024, the average UK home costs around £264,384, and the house price-to-earnings ratio has soared to 9x the average salary in recent years—a figure not seen since 1876. By contrast, that ratio was around four times the average salary in the 1980s.

So while the 80s had scary mortgage rates, today’s buyers face a longer, tougher slog to save up enough just to get on the ladder.

Deposits, delays and dream homes

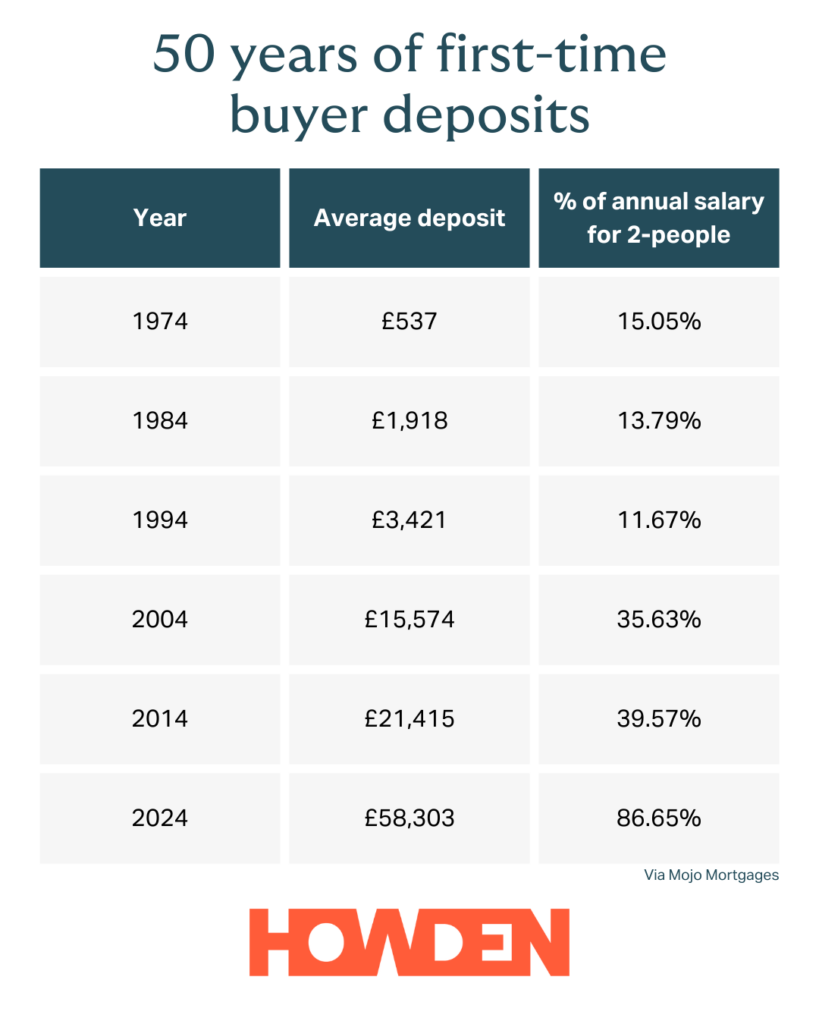

Let’s talk deposits. In 1974, the average deposit was just £537—a manageable 5.36% of the property price. Fast-forward to today, and the average deposit sits at over £58,000, now making up a whopping 22% of the purchase price.

It’s no wonder that saving for a deposit takes around 11 years for the average couple today, compared to just six months in the 70s. And with most first-time buyers now in their early 30s rather than their mid-20s, the gap between starting adult life and home ownership is wider than ever.

The buying process itself has changed too. Where once a handful of interested buyers might have turned up to view a property, today’s buyers are battling bidding wars, sealed offers, and FOMO-fuelled* competition in even modest property markets. The timeline has also stretched, with legal delays, surveys, and mortgage checks extending the process by months.

*That’s Fear Of Missing Out, in case you don’t know the lingo!

It’s not just house prices on the rise – think about insurance too!

While house prices get most of the attention, there’s another number that’s quietly creeping up: rebuild costs.

Back in the 80s, the cost to rebuild a home was a fraction of today’s figures. Construction materials were cheaper, labour costs lower, and building regulations simpler. Fast forward to now, and the average rebuild cost has risen significantly, driven by inflation, material shortages, and increased labour demand.

For many homeowners, this means the sum insured on their buildings insurance is out of date. And if your cover doesn’t match the real cost to rebuild your home, you could be underinsured—potentially thousands out of pocket if something goes wrong.

An alarming 76% of UK buildings remain underinsured. While that’s a slight improvement from 81% in 2023 and a peak of 83% in 2022, the figures are still worryingly high.

What’s more, for properties that are underinsured, the level of cover still falls drastically short. On average, these homes are only insured for 63% of what they should be—a figure that mirrors last year’s record low.

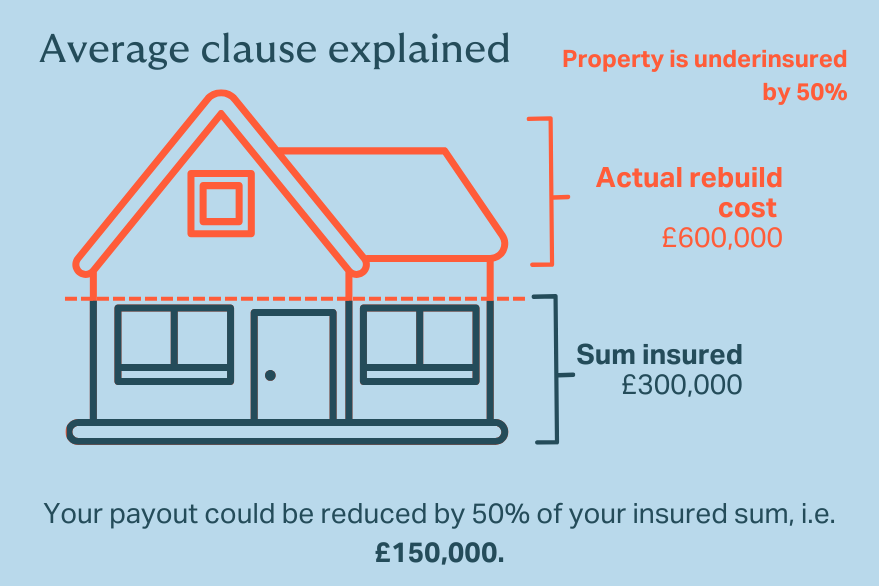

When dealing with underinsurance, insurers apply the average clause and only pay out a proportionate amount for what you are claiming based on how much you are underinsured by. So if you insure a property for £300,000 but in reality, it would actually cost £600,000 to rebuild. The insurer reserves the right to deduct the percentage that you are underinsured by. So in this case, as you’re 50% underinsured, you could receive just 50% of what you were insured for, so £150,000.

Why have rebuild costs gone up?

A few key culprits:

- Inflation – Building costs rise in line with (or often above) inflation, meaning a rebuild now could cost far more than a policy taken out a few years ago accounts for.

- Material costs – Global supply issues, Brexit, and energy prices have all pushed up the price of raw materials like timber, concrete, and steel. Between January 2022 and today, construction and materials costs in the UK have risen by between 25% and 35% cumulatively.

- Labour shortages – A lack of skilled workers in construction has driven wages up, increasing overall project costs.

- More regulations – New homes and renovations now need to meet higher environmental and safety standards, which come with a higher price tag.

Advice for boomers, millennials, and everyone in-between!

So, who had it worse? There’s no easy answer. The 80s generation battled monstrous mortgage rates and the looming threat of repossession. Today’s buyers face brutal affordability issues, slower timelines, and sky-high deposits.

But one thing is clear: insurance needs have changed—and many homeowners haven’t kept up. If you haven’t reviewed your buildings insurance in a while, it’s worth checking that your rebuild value is accurate. It’s not just about what your home is worth to sell—it’s about what it would cost to rebuild from scratch.

And with rebuild costs rising faster than many realise, getting that number right could be the difference between being covered and being caught short. Whatever generation you fall into, getting the right insurance advice is crucial. And with our insurance experts available in high street branches across the UK and over the phone, we’re here whenever you need us, however you need us.

Search Howden Insurance to find your nearest branch, and get in touch!

Sources: This Is Money, RightMove, Nationwide, Metro, The Standard, Savills, Bank of England, Rebuild Cost Assessment.

You could also read:

- Car insurance prices drop 23% for young drivers!

- The most iconic on-screen number plates

- Good debt vs bad debt when buying a home

- Five hidden costs that could derail your holiday!

- 20mph zones – how effective are they?

This is a marketing blog by Howden Insurance.