We’re all familiar with the holiday checklist – swimsuits, sunhats, and that all-important beach read. But one thing many of us forget to tick off before heading out the door is making sure our home is properly protected.

While we’re off relaxing, crime rates – particularly burglaries – tend to climb. Data from the Office for National Statistics shows a rise in break-ins during the summer months, and Aviva reports that burglaries increase by 48% between July and September. That makes securing your home before your trip more important than ever.

How to protect your property while you’re away

1. Lock up properly

It may sound obvious, but double-check that all windows and doors – including garages and side gates – are securely locked. Don’t forget to bring in any spare keys you usually hide outdoors.

2. Be careful on social media

As tempting as it is to post beach selfies in real-time, avoid broadcasting your trip until you’re safely back home. Posting updates while you’re away can signal to opportunistic burglars that your house is empty.

3. Manage your deliveries

Pause any regular deliveries and avoid ordering anything that might arrive while you’re away. A pile of parcels or a bulging letterbox is a clear giveaway that no one’s home. If possible, ask a neighbour to collect your post for you.

4. Hide your valuables

In the unfortunate event that someone does break in, don’t make it easy for them. Burglars often head straight to the main bedroom, so don’t keep jewellery or valuables there. Store them in unlikely places – think food cupboards, laundry baskets, or inside old toys. Better yet, invest in a small safe and secure it inside a cupboard.

5. Make the house look lived in

If you’re going to be away for more than a day or two, consider using timers to switch your lights on and off in the evenings. TV simulator lights are another inexpensive way to make it seem like someone’s inside. Bonus points if a neighbour can park in your driveway while you’re gone.

6. Secure sheds and outbuildings

Your garden shed or garage can be just as appealing to thieves as your house. Use strong locks on doors and windows, and keep valuable items out of sight. You can also mark tools and bikes with your postcode, or move expensive gear indoors. Motion-sensitive shed alarms are another effective deterrent.

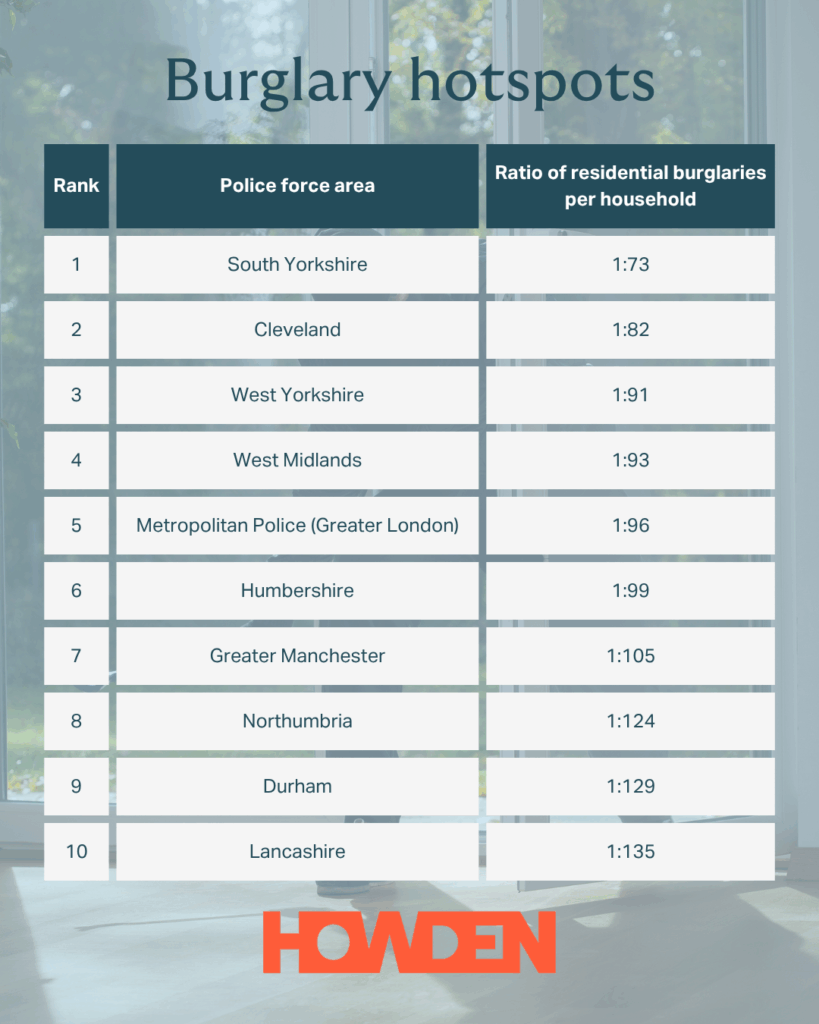

Burglary hotspots – are some areas worse than others?

Unfortunately, break-ins aren’t spread evenly across the UK. Some areas experience far higher burglary rates than others, and this can affect more than just your sense of security – it can impact your insurance, too.

How break-ins affect your insurance

If you live in a neighbourhood with higher-than-average burglary rates, you may find that your home or contents insurance premiums are higher. This is because insurers view certain areas as riskier.

However, there are ways to help reduce the cost of your cover. Joining or setting up a Neighbourhood Watch scheme, for example, may lower your premium – insurers often give discounts in areas with active community safety groups.

Other ways to cut your contents insurance costs include:

- Improving home security (e.g., installing an intruder alarm)

- Increasing your voluntary excess (though this means paying more if you need to claim)

Why insurance still matters

An estimated third of all residential burglaries in 2024 occurred in uninsured homes – that’s over 56,000 households. With the average cost of a burglary reaching around £4,120, that adds up to roughly £93.8 million in losses for homeowners without cover.

So before you pack your flip-flops, take a few minutes to prepare your home. A little planning can go a long way in keeping your property – and your peace of mind – safe this summer.

If you’re not sure what’s included in your current policy or want to check that you’ve got the best cover for your home, our insurance experts are happy to help. Simply find your nearest Howden branch and pop by or give the team a call – whichever suits you!

Sources: Crime Prevention Services, Good Housekeeping, GoCompare.

You could also read:

- Hidden risks in your garden

- Can you be insured for ‘travel anxiety’?

- Home improvements that don’t need planning permission

- Are you a target for ‘crash for cash’ scammers?

- Cyberattacks: how to protect your data

This is a marketing blog by Howden Insurance.