How much should I be paying for my first-time driver insurance? How does new driver car insurance differ from experienced drivers’ policies? Which cars are best to insure under a young driver insurance policy? How much cover and protection do I need as a new driver?

There’s always so many questions when it comes to the topic of new driver insurance, with often way too many answers out there that can make choosing your policy even more confusing.

However, you’ve come to the right place, as in this blog you’ll find everything there is to know about car insurance for new drivers, allowing you to make more educated decision when it comes to buying your first-time car insurance policy.

- Do new drivers need car insurance?

- What is the difference between driving on a parent’s insurance or new driver car insurance?

- What cars are cheapest to insure for new drivers?

- What is the best type of insurance for a new driver?

- How much is car insurance for a new driver?

- What is black box insurance?

- Summary

Do new drivers need car insurance?

Yes, new drivers do need car insurance as no matter what experience you have driving, everyone is required to have car insurance in order to drive any vehicle.

However, for new drivers who may not be able to afford a car or an insurance policy, they can be added to someone else’s policy as a named driver, which will enable them to drive their car under their policy.

If you are caught driving a vehicle as a young driver, as a new driver, or as a driver with years of experience, without car insurance, you will face a fine and get penalty points on your driving licence.

Outside of what is required by law, New Driver car insurance is also highly recommended to protect the driver financially in the case of an accident or incident.

What is the difference between driving on a parent’s insurance or new driver car insurance?

There are several key differences between driving on a parent’s insurance and obtaining new driver car insurance:

- Ownership: If a new driver is driving a car that they own, they will need to obtain their own insurance policy. However, if they are driving a car that is owned by their parents, they may be able to be added to their parents’ existing insurance policy as a named driver.

- Premiums: Insurance premiums for new drivers are typically higher than those for more experienced drivers, due to the increased risk of accidents. Adding a new driver to an existing insurance policy may result in an increase in premiums, but it is generally less expensive than purchasing a separate new driver car insurance policy.

- Coverage: The level of coverage provided by a parent’s insurance policy may vary depending on the specific terms of the policy. New driver car insurance policies may offer additional benefits, such as a courtesy car in the event of an accident or breakdown.

- No claims discount: If a new driver is added to their parent’s insurance policy, they will not build up their own no claims discount, which can lead to higher premiums in the future. However, if they purchase their own new driver car insurance policy, they may be able to earn their own no claims discount.

It’s important to compare different insurance options and choose the policy that provides the best coverage at an affordable price. You can find out more on our website, where young drivers can get an online quote and qualify themselves for a genuine no claims bonus at the end of the policy term.

Be aware of Insurance Fronting!

There are cases where false information is provided to insurers with the aim of lowering insurance premiums. Insurance fronting is an example of this.

Insurance fronting is a form of car insurance fraud, and it is illegal. This is when a driver declares to an insurance provider that they are the main driver of a vehicle, when in fact, the main driver is actually someone else.

For example, someone might choose to falsely insure a vehicle in their own name, perhaps an older, more experienced driver, to lower the insurance premiums for a younger, higher-risk driver.

Insurance fronting is most often caught whenever a claim is made, and this could invalidate an insurance policy and end up with the fraudsters being charged and potentially taken to court.

What cars are cheapest to insure for new drivers?

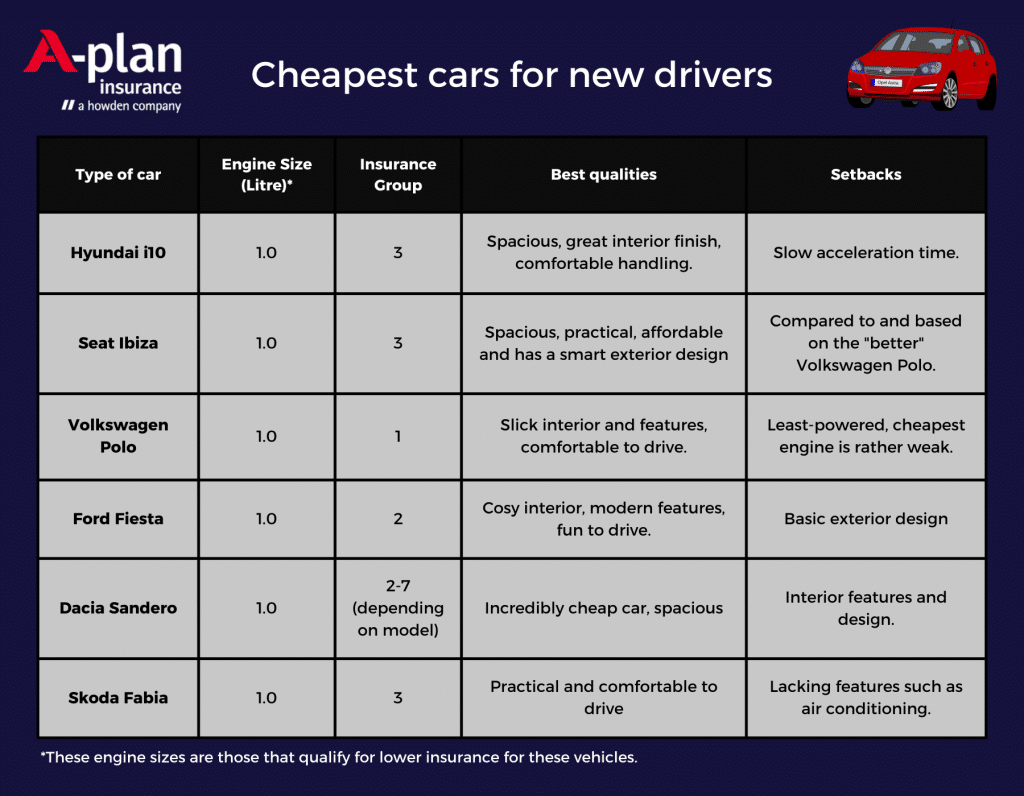

The cars which are cheapest to insure changes year on year. The insurance climate is always changing and how insurers differentiate how safe and secure a car is constantly being re-invented following the release of new cars or the conducting of new studies.

For example, car prices can affect insurance prices. With car prices rising and rising, the cost to repair or replace a car that has been in an accident could be higher, thus forcing insurers to increase insurance premiums.

However, despite this, we do still have a good idea of the cars which are currently cheapest to insure in 2023. We’ve had a look around various sources and created the table below which shows some of the most recommended cars we could find which offer cheap car insurance for both new or young drivers.

As we’ve said already, the cheapest cars to insure will continue to change in years to come, so it important that you do your research and explore current car insurance options to find the best deals for you, as every new driver is different.

What is the best type of insurance for a new driver?

There are three types of car insurance which new drivers need to be aware of. The best type of car insurance will depend on your preferences and how much financial protection you believe you will require. The three options to look out for are as follows:

- Third-party only – this is the minimum legal requirement for car insurance in the UK. It covers only the costs of damage or injury caused to other people and their property. For the least amount of coverage, it is naturally the cheapest option.

- Third-party, fire and theft – this covers everything third party car insurance covers, but also includes protection against theft or fire damage to your own car.

- Fully comprehensive – this is the highest level of cover that you can buy. It provides protection against damage to your own car as well as damage or injury caused to other people and their property. For the largest amount of coverage, it is the most expensive option.

Car insurance quotes for new or young drivers will be offered based on one of these levels of cover, so it is important that policy holders understand exactly how much protection they need before they go ahead to buy.

How much is car insurance for a new driver?

Car insurance for first time drivers can vary in cost depending on several factors. Where the vehicle is kept, the driver’s age, their driving history, the type of car they want to insure, how they will use the vehicle (e.g. is it used to commute?) and even their gender will all influence how much a policy will cost.

Insurers will also look at data to work out how safe and secure a car is, which will influence how insurers weigh up the chances of an accident occurring, or the vehicle being stolen.

Furthermore, age is a factor. According to the Association of British Insurers (ABI), the average cost of car insurance for drivers aged 17-24 in the UK is significantly higher than the average cost for drivers over the age of 25.

Despite this, there have been studies conducted into how much new drivers car insurance costs, to give you an approximate idea of how much you will need to spend. It’s harder to estimate for new drivers at any age, but young drivers on average, (in the UK) should expect to pay around £1,800 per year to insure their car. (Moneyshake, March 23)

The price of your insurance will be cheaper if you opt to pay for the policy upfront, for the entire year. However, those who can’t afford to pay upfront can instead pay in monthly instalments.

It’s also worth noting that learner drivers who take out an annual policy whilst still a provisional license holder could get their car insurance to be much cheaper than waiting until once they’ve passed their test, as some insurers will not allow an increase to your premium once its passed.

Why do young drivers not get cheaper car insurance?

Young drivers are deemed to be ‘high-risk’ when they’re out on the road, due to their lack of driving experience. It is for that reason that young drivers therefore may face higher insurance premiums.

However, there are ways that new or young drivers can reduce their first insurance premiums and get cheaper car insurance. This includes completing a Pass Plus course, or insuring a car with a smaller engine. Young drivers can also opt to insure themselves on a black box insurance policy in the hope of getting the cheapest car insurance too.

No matter your age, it is worth speaking to a broker who can present you with a range of options – and carefully explain how the insurance would work.

What is black box insurance?

Black box insurance is a type of driver insurance which uses telematics technology to monitor the policy holder’s driving habits. Because of the technology that is used to monitor, you may have heard this type of young driver insurance referred to as telematics insurance.

The black box, which is a small device fitted to your car, uses GPS and other sensors to collect data about your driving, such as your speed, acceleration, braking, cornering, and overall driving behaviour. This data is then sent to your insurance company, which uses it to assess your driving risk and adjust your premiums accordingly.

Do I have to use black box car insurance as a young driver?

No, as a young driver you are not required to use black box car insurance.

However, for young drivers it may be a good option to consider as it can be a more affordable way to insure their car. By monitoring your driving habits, insurers can better understand your individual risk profile and offer personalized premiums that are based on your actual driving behaviour, rather than on generalizations about your age or gender.

In addition to potentially lower premiums, black box insurance can also provide benefits such as theft recovery assistance, emergency response, and the ability to track your car’s location in the event that it is stolen.

However, it’s important to keep in mind that black box insurance policies may come with certain restrictions, such as mileage limits or curfews, so it’s important to carefully read and understand the terms of the policy before signing up.

If you’re based in the area, you could visit the A-Plan Oxford branch who specialise in Young Driver insurance and can offer any advice around the option of black box / telematics insurance.

Summary

Picking out your young driver insurance or car insurance policy as a new driver can be a daunting experience, especially when you don’t have all the facts and information that you need at your disposal. Also, because there are so many offers available, it can be hard to know which deal is the right one for you.

The best bit of advice we can give is: do your research, speak to a broker, and understand the difference in the types of insurance available versus the price you will pay.

Once you know how much cover you want for your car and the amount you’re willing to pay, picking the perfect policy will be more straightforward.

You can easily talk to an insurance broker, such as A-Plan, about what you would expect from your new driver car insurance policy. Provide them with as many details about yourself and your car as possible, so they can source you the cheapest insurance premiums available on the market within their panel of insurers.

Have you passed your driving test and ready to get out in your new car? Are you a little unsure though of what new driver insurance you need? A-Plan has a team of first time car insurance specialists who would be more than happy to help and answer any questions you may have!

You can also read:

- How to check if a car is insured?

- How long does an MOT take?

- Motorcycle MOTs: all you need to know

- Road tax exemption

- UK provisional driving licence: A complete guide

- Lost V5c: How to get a replacement logbook

- SORN my car: How to declare your vehicle as off the road

- What is a Cat N car?

- How to check if a car is insured?

- Free MOT checker – Check a vehicle’s MOT history

- Try our free-to-use Car Tax Checker