Running a business is challenging enough without worrying about insurance. Yet with premiums rising, many businesses are tempted to cut corners. But beware— ‘underinsurance’ and ‘uninsurance’ are growing problems that could leave you dangerously exposed.

While some forms of insurance are legally required, others are simply essential for protecting your business from crippling costs. So, how can you safeguard your business from these risks? Let’s dive deeper into the dangers of going ahead without the right insurance protection.

Underinsurance vs uninsurance – what’s the difference?

Put simply, underinsurance is not having the right level of cover. Many people view insurance as a ‘tick-box’ exercise, just another thing on your to-do list. But that can lead to your cover not being sufficient for your needs.

And being uninsured is when you don’t have any policy in place at all. So your cover isn’t just inadequate – it’s non-existent!

Why are these issues so worrying? Well, if you’re uninsured for something that you legally must be insured for, such as your van or employer’s liability insurance, then you face criminal and financial consequences.

Other policies, such as public liability or professional indemnity insurance aren’t a legal requirement. But they are hugely beneficial.

Public liability insurance, for example, could help if a member of the public claimed against you for injury or damages suffered as a result of your business activities. Or professional indemnity could cover the legal costs of someone taking you to court if they consider your work substandard.

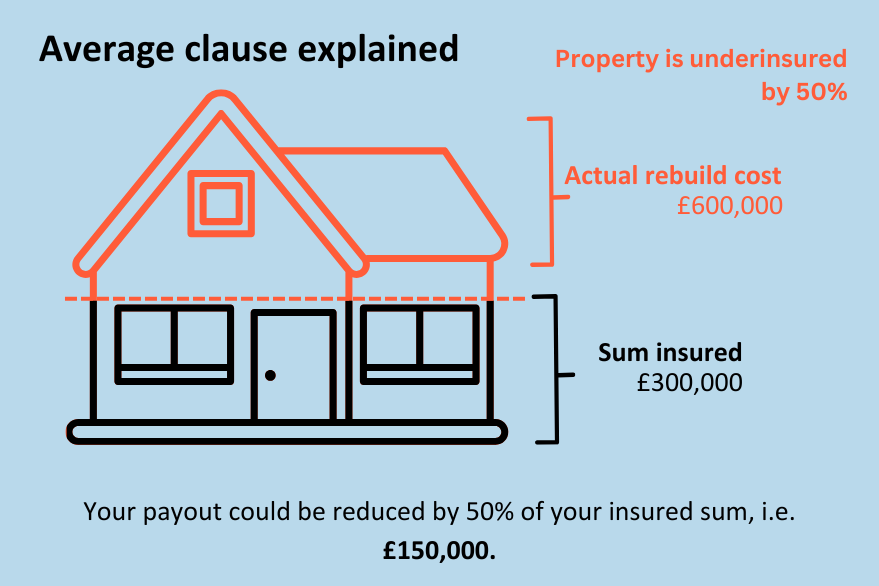

The average clause explained

Take a look at the small print of your insurance documents and you’ll likely see something about the average clause. This is something insurers refer to if you need to make a claim, but you’re inadequately covered. Insurers apply the average clause and only pay out a proportionate amount for what you are claiming based on how much you are underinsured by.

Let’s say you insure a property for £300,000 but in reality, it would actually cost £600,000 to rebuild. The insurers are unlikely to pay out the agreed amount, but also reserve the right to deduct the percentage that you are underinsured by. So in this case, as you’re 50% underinsured, you could receive just 50% of what you were insured for, so £150,000.

And, it can get much more complicated. If an insurer feels they would not actually have agreed to the policy initially had they’d known the accurate rebuild cost. They could potentially pull out of the claim entirely.

Lewis Ellis, Commercial Account Executive at Howden Northampton, explained: “The danger is that if you have to make a claim while underinsured, you’ll only get compensated for the value you’re insured for – not the full value of any damages. And that means the remaining costs will fall on you to pay.

“It’s incredibly worrying, as the number of businesses going bust is at an all-time high. Being incorrectly insured, your business could be just one claim away from going bankrupt.”

What’s the extent of the problem?

Both uninsurance and underinsurance are on the rise – and that should worry us all. More than half (51%) of SMEs have stopped buying at least one form of business insurance, and so are uninsured. In addition 46% of commercial properties are underinsured, and the shortfall sits at an average of 43% against the rebuild value. Last year, BCH, the UKs leading provider of Reinstatement Valuations (how much a property would cost to rebuild), found underinsurance in 67% of the cases it reviewed for reinstatement in 2023.

Research shows that underinsurance is being driven by commercial property owners not carrying out regular valuations of their premises. What’s more, rebuild and repair times have increased significantly over the last five years, as have material and labour costs, which has a massive knock-on effect on business closures or interruption periods.

How to avoid underinsurance

Underinsurance is avoidable. But it takes care to ensure you have the right policies in place – worthwhile time to protect your livelihood and all the effort you put into running a business. So what should you do to get the right cover?

Firstly, regular valuations and reviews of your business operations, property and assets are vital. The Royal Institution of Chartered Surveyors (RICS) recommends taking a full reinstatement cost assessment every three years, as well as when significant changes, such as an extension, are made to a building. At Howden, we recommend clients take out a survey by BCH BARRETT CORP & HARRINGTON to assess their rebuild costs.

And you should review your sums insured before renewing your business insurance – don’t just assume it’ll be the same, year after year. Inflation has pushed up prices across the board, and it’s important to make sure your valuations are correct.

Secondly, consider the length of time you have in place for business interruption periods. The British Insurance Brokers Association estimates that 43% of companies’ business interruption coverage is around half what it should be, at a year. Supply chain issues, shortages of labour, and the complexity of rebuilding IT systems can mean that it can take up to two years to get a business back up and running.

Finally, don’t underestimate the value of your business to try and get cheaper cover. Stripping your business insurance down to the barest of essentials could leave you exposed and underinsured. In the event of a claim, you could end up paying far more than you could ever save.

Expert help is here

Time-consuming, intimidating, or just downright boring – these are all common reactions to drilling down into the finer details of your business to sort your insurance. But getting an accurate picture of your business activities, up-to-date valuations and seeking the right advice is vital.

That’s why we recommend talking to an insurance expert, rather than relying on online forms alone. Lewis continued: “If you’re buying a policy online, some insurers might not tell you if you’re underinsured. That’s why working with an expert is so vital. At Howden, we can help you find tailormade, flexible cover that provides protection against the risks unique to your business.

“We work to identify your exposures, as we recognise the risk of being underinsured. From not having Cyber Cover to then experiencing a data hack or contract works making you liable for the cost of the additional labour and materials. We want to help you find the right level of cover, so that if you needed to make a claim, you’re properly protected.”

An insurance expert can get to know the full picture of your business, your needs and find a tailored policy. At Howden, we’re a specialist broker, offering cover for all types of small businesses.

We’re not about cookie-cutter, off-the-shelf, one-size-fits-all insurance. We do people-first insurance, understanding the specifics of your insurance needs and matching them with the insurer that’s best placed to provide that cover, at the right price. Find your nearest commercial branch and give our friendly team a call or stop by!

Sources: Lloyds Bank, Insurance Age, Insurance Age

You could also read:

This is a marketing blog by Howden.