When it comes to buying a home, your financial history plays a crucial role in determining how much you can borrow. Whether you’re a first-time buyer or looking to move up the property ladder, understanding the difference between good and bad debt is key.

With more people turning to finance options for big purchases—from credit cards to buy now, pay later schemes—household debt in the UK is on the rise. But how does this impact your mortgage application? While some types of debt can work in your favour, others might reduce the amount you can borrow or even affect your chances of securing a mortgage at all.

Good and bad debt: what’s the difference?

Good debt is so-called because it’s used to generate income or wealth in some form. You may also hear it referred to as leverage. Buying property and getting a mortgage is considered ‘good debt’, as are student loans for education or loans to start a business.

On the flip side ‘bad debt’ is borrowing money from creditors to spend on things that don’t bring a financial return. It must be repaid, and usually with high interest rates. Credit cards can be a useful tool for building up your profile as someone that’s financially reliable – but only if you’re able to pay off the debt, keep a low credit utilisation ratio and keep up with regular payments.

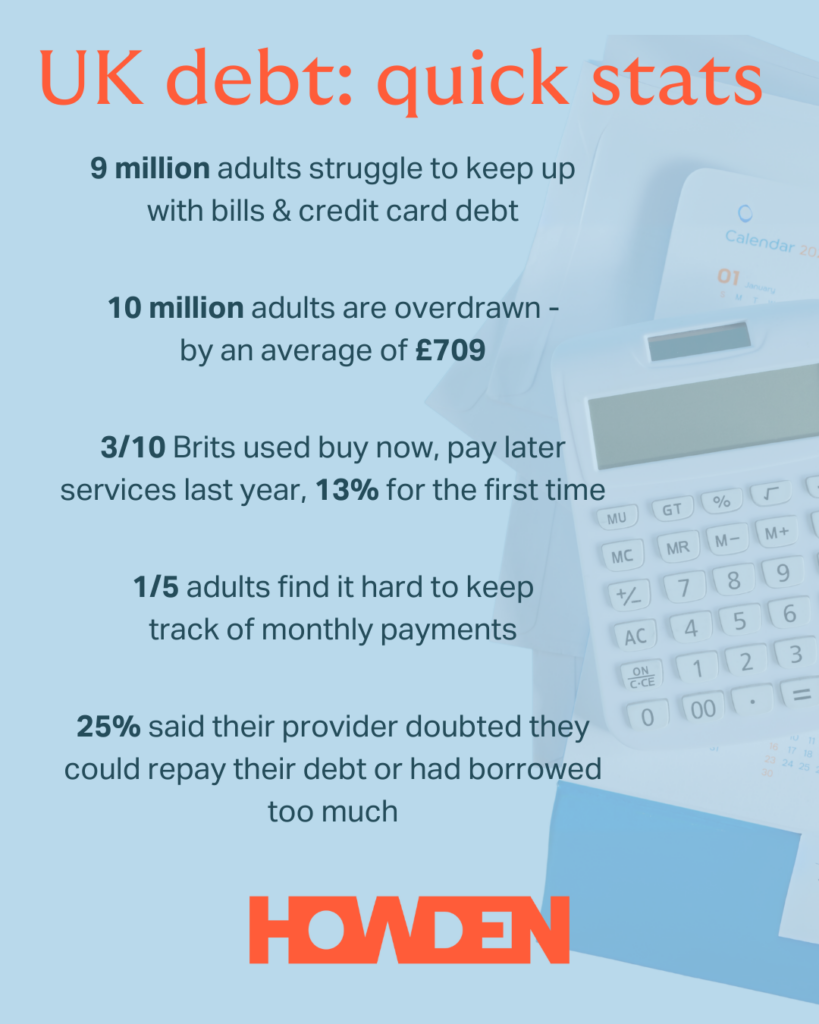

What’s alarming, yet understandable after the turbulence of the cost-of-living crisis, is that nine million adults (17%) say they are struggling to keep up with bills and credit card debt, and have recently borrowed to pay for essentials.

Moreover, almost 10 million adults in the UK are overdrawn, by an average of £709, with some banks charging an astounding 49.90% on overdrafts. And three in 10 Brits used buy now, pay later services last year, with 13% doing so for the first time. So bad debts are a growing financial burden, which can also have a long-term impact on your ability to borrow.

How your purchases – and how you pay – impact your mortgage offer

Mortgage lenders consider a number of things in addition to your deposit, the property you want to buy and loan you want to take out. Your job, what you earn, whether you have dependents, credit history and spending habits are all part of assessing your affordability and calculating an offer.

Take for example, buying a new car on finance. Coventry Building Society recently crunched the numbers based on a £345 monthly agreement for a Ford Puma over 36 months – a recent offer available on Ford’s website. Joint buyers, both earning the average salary, could borrow £13,205 less if they each had an additional £345 outgoing on their own car. Lenders consider car finance as a fixed outgoing and therefore deduct this from your income figure.

Now, having a strong payment history is good for your credit score, which is something that lenders will also consider. But if you are making a large purchase via a finance deal that lasts several months, or even years, you need to think about how that could impact your mortgage chances later down the line.

Mark Harris, Chief Executive of mortgage broker SPF Private Clients, says:

“Long gone are the days when lenders worked out how much you could borrow simply by multiplying your income by three or four times. Now they look at the bigger picture, working out your affordability – looking at your outgoings and spending commitments as much as your income.

“We always recommend that before applying for a mortgage, borrowers scrutinise the outgoings on their bank and credit card statements. Do you really need that monthly gym membership when you hardly ever go or that gaming subscription?

“Likewise, any other debts you have recently taken on, such as car finance, will impact the size of mortgage you can obtain, so delaying purchasing that new car could be a prudent move. Cutting back on unnecessary commitments or expenditure should help boost your mortgage borrowing.”

Mark also recommends consulting a whole-of-market mortgage broker such as SPF, part of Howden, at the start of the process. A broker will flag any issues with your credit rating or financial affairs and select a product and lender best suited to your individual circumstances.

Learn more about how a mortgage broker can help through SPF. And whether you choose to remortgage, stay put, or move house, your local Howden branch is always available to discuss any changes to your home insurance.

Sources: Equifax, London Loves Business, Your Money, Stepchange

You could also read:

- Top tips for avoiding a claim crisis

- How much is your water bill rising by?

- The UK’s happiness hotspots

- Will banks completely disappear from our high streets?

- Insuring the extraordinary

This is a marketing blog by Howden Insurance.