April hit hard. Rising bills, expensive groceries, and general cost-of-living fatigue made it feel like ‘awful April’ was living up to its name. But if you’re a driver, there’s one silver lining on the horizon—car insurance might finally be heading in the right direction.

By the time we hit early 2024, car insurance had become a real pain point—just one more thing squeezing already-stretched household budgets. Even chocolate has gone up! But now, there’s a glimmer of hope, because car insurance premiums, which hit record highs not long ago, are finally starting to come down.

How expensive is car insurance right now?

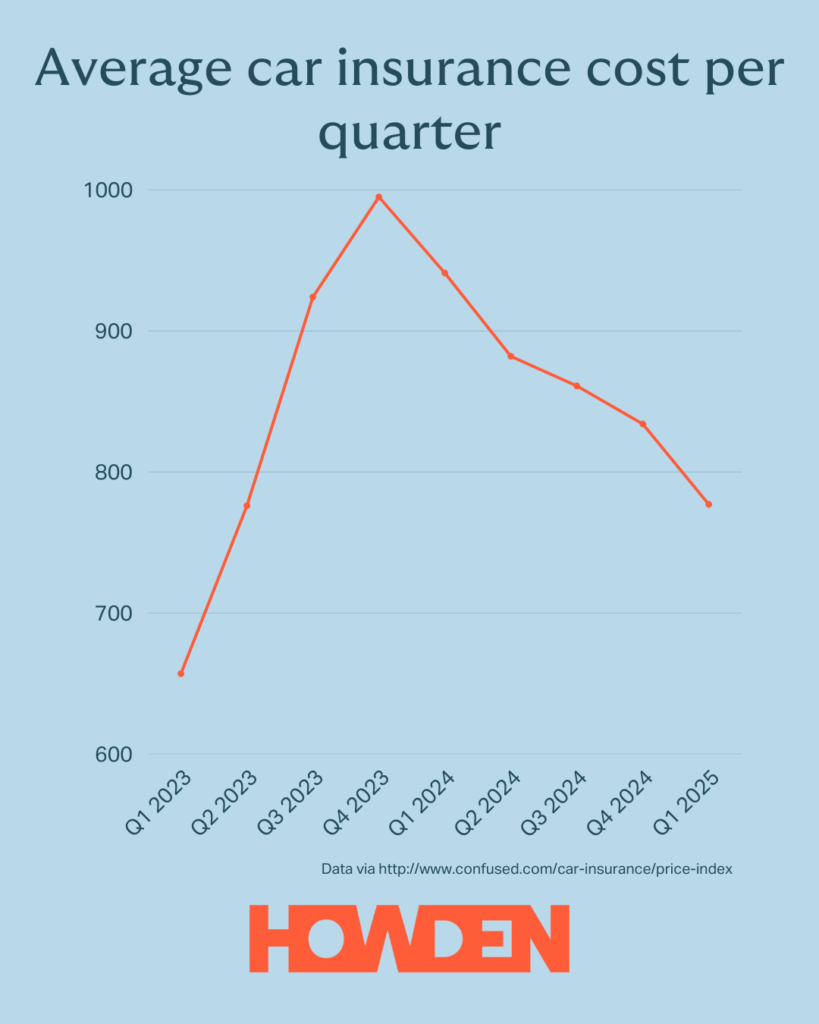

Here’s the headline: the average UK car insurance premium is now £777. Not exactly cheap, but definitely better than the near-£1,000 figure we saw at the end of last year.

And it’s not just national data showing a drop—our own client data for 2025 so far is show positive signs. Over half (56%) of our clients are seeing lower renewal quotes this year—at least 5% cheaper than 2024. And only 10% are facing those painful hikes of 25% or above.

Compared to last year? It’s a big improvement!

Let’s rewind to the end of 2023, when the average car insurance premium hit a whopping £995. That was a record-breaking high, and it really stung.

Fast forward to now, and premiums are down by £164, or about 17% compared to March 2024. Things have been gradually improving since early last year, after a tough period of inflation, supply chain chaos, and rising repair costs sent premiums soaring.

We’re still not back to the prices we saw pre-pandemic, but the downward trend is clear—and very welcome.

Biggest wins for younger drivers

Good news if you’re just getting behind the wheel: younger drivers are finally catching a bit of a break. Those aged 17–20 are seeing some of the biggest drops in premiums. Here’s what that looks like:

- 18-year-olds are now paying around £2,434, which is £711 (23%) less than they were this time last year.

- 17-year-olds are shelling out £2,258, down £661 (also 23%) from 2024.

Sure, those prices are still eye-wateringly high compared to older drivers—but this is the lowest they’ve been for nearly two years.

Read more about insuring young drivers here.

But why are some people still paying so much?

If your quote came in higher than expected, you’re not alone. Not everyone is benefitting from the drop—and there are still some big pressures keeping prices up.

In 2024, UK insurers paid out £11.7 billion in motor insurance claims. That’s a huge strain on the industry. The average claim rose by 13% to £4,900, and repair costs alone hit a record £7.7 billion—a jump of £1.5 billion from 2023.

Modern vehicles are more complex, which means they’re more expensive to fix. And as electric cars become more common, specialist repairs are pushing costs even higher. So while premiums are coming down overall, it’s not happening equally for everyone just yet.

How can you save on your car insurance right now?

There are ways to make your premium work harder for you—especially when it’s time to renew. Here are a few tips that could help trim the cost:

Consider a black box

AKA telematics, this can be especially useful for young drivers looking to save on their premium.

Check your mileage

If you’ve been working from home more or driving less, make sure your policy reflects that.

Adjust your voluntary excess

Just make sure it’s still affordable if you need to make a claim. You could also look at excess protection, which could see your excess refunded to you if you had to claim.

Add a named driver

A more experienced driver on your policy can sometimes reduce your premium. Just make sure that whoever owns the car and is driving it the most is the policy holder, to avoid fronting.

Speak to a broker

A broker, like us here at Howden, can help you find the best value for your specific driving needs, and even find policies and deals that you won’t online.

So, is this the start of a positive trend?

We certainly hope so. After months of doom and gloom around rising costs, it’s refreshing to see car insurance heading in the right direction. Whether you’re a new driver or have been on the road for decades, there’s a good chance your next renewal might be a bit less painful than the last one.

And if it’s not? We’re always here to help you find ways to save.

Sources: Which?, Confused.com, Consumer Intelligence, ABI

You could also read:

- Car insurance prices drop 23% for young drivers!

- The most iconic on-screen number plates

- Good debt vs bad debt when buying a home

- Five hidden costs that could derail your holiday!

- 20mph zones – how effective are they?

This is a marketing blog by Howden Insurance.