Homeowners should heed this stark warning from the Environment Agency (EA) that around a quarter of properties in England (eight million) could be at risk of flooding by 2050 as the danger increases due to climate change.

With the increasing number of homes being redesignated as flood risks and new developments in flood-prone areas, understanding the implications for home and contents insurance is more important than ever.

So just how severe is the issue, and is your home at risk?

How many homes are at risk of flooding?

Currently, 6.3 million properties are considered at risk from flooding, new figures show, which is much higher than previously thought. The EA assesses flooding risks from three primary sources: rivers, the sea, and surface water—when heavy rainfall overburdens drainage systems.

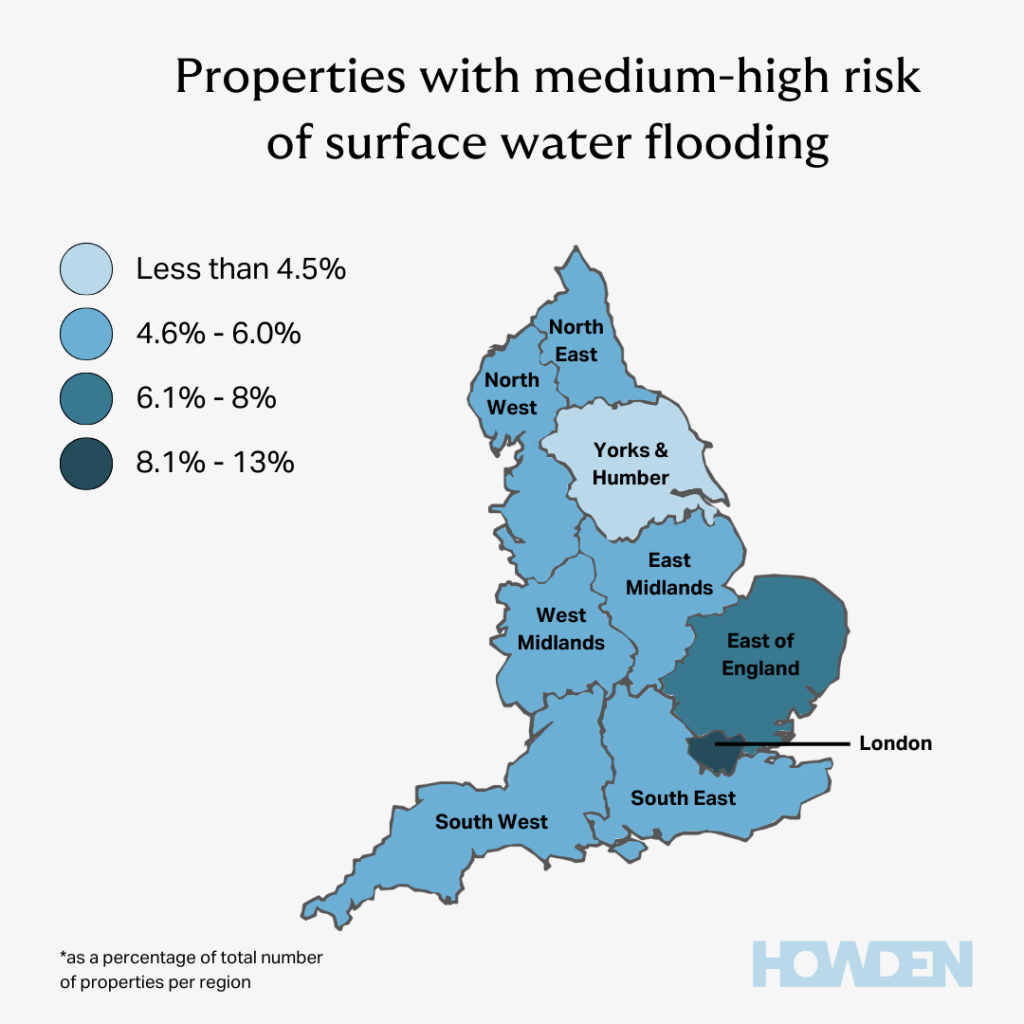

Properties are classified as “at risk” if their annual likelihood of flooding exceeds one in 1,000. The EA says that 4.6 million homes and businesses are currently at risk of surface flooding, a staggering 43% increase compared to earlier estimates. These revised figures come thanks to enhanced datasets and advancements in computer modelling, rather than an actual increase in flood risk. Here’s how regions of England compare for surface flooding risk:

What’s more, climate change could push the number of properties at risk of surface flooding to more than six million by 2050. Between just October 2023 and March 2024 alone, the UK experienced an average 20% increase in rainfall on the stormiest days due to climate change.

And surface flooding is not the only risk. The report also underscores a growing threat of flooding from rivers and the sea, with the number of affected properties projected to rise from 2.4 million today to approximately 3.1 million by the middle of the century.

The East Midlands, Yorkshire and The Humber, and south-east England are particularly at risk, with flooding from rivers overflowing their banks or storm surges pushing seawater inland being especially destructive, as it often results in deeper floodwaters.

Why are homes built on floodplains?

It’s no secret that there’s high demand for housing in the UK. The Government has set a requirement to build 370,000 homes a year, for the next five years. But safer land is limited, and so despite all these known risks, homes continue to be built on floodplains.

In some cases, developers implement flood mitigation strategies, such as improving flood defences and raising the land level of new developments. However, these measures may not always be sufficient to counteract the increasing risks posed by climate change.

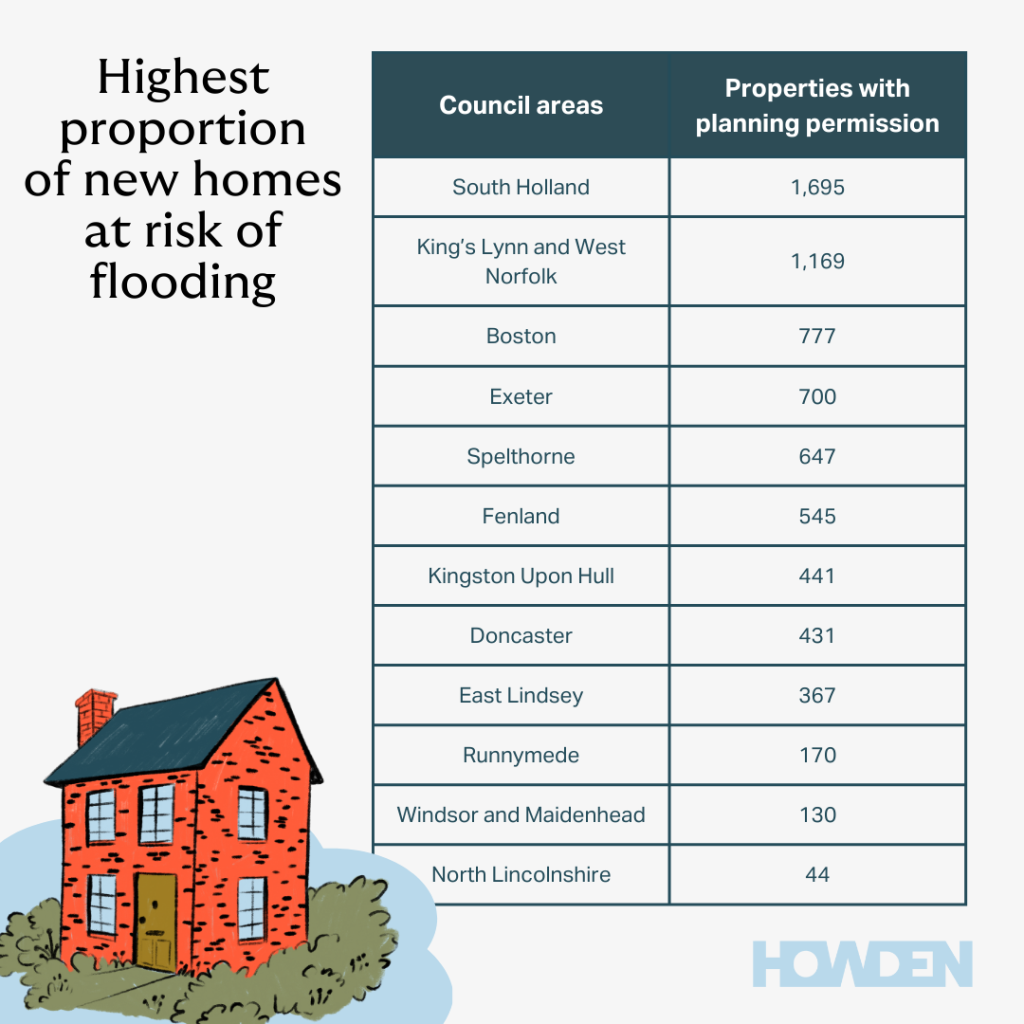

For example, planning permission has been granted for more than 7,000 homes in the areas of England that are at the highest risk of flooding. In England, there are 12 council areas where more than one in 10 properties face at least a 1% risk of flooding. This is the benchmark for being deemed high risk.

Independent think-tank Localis revealed that 7,116 new homes have full or conditional approval to be built on previously undeveloped floodplain land in the 12 council areas with the highest proportion of homes at flood risk. These are:

The impact on your home insurance

Living on a floodplain can have significant implications for your home and contents insurance. Here are some key points to consider:

Higher premiums: Homes in flood-prone areas typically face higher insurance premiums. This is because the risk of flooding increases the likelihood of claims, leading insurers to charge more to cover potential losses.

Mandatory flood insurance: In high-risk areas, flood insurance may be mandatory. This ensures that homeowners are protected in the event of a flood, but it also adds to the overall cost of homeownership.

Limited coverage options: Some insurers may be reluctant to provide coverage for homes in flood zones, or they may offer limited coverage options. This can make it challenging for homeowners to find adequate protection.

Increased claims and payouts: Flooding can cause extensive damage to both the structure of a home and its contents. As a result, claims for flood damage tend to be higher than for other types of incidents, leading to increased payouts by insurers.

What should you do if your home is on a floodplain?

If you live in or are considering purchasing a home in a flood-prone area, there are several steps you can take to mitigate the risks and manage your insurance costs:

Check flood maps: Use tools like the EA’s Flood Map Service to determine if your home is in a flood zone. This can help you understand the level of risk and make informed decisions about insurance coverage.

Invest in flood defences: Consider installing flood defences, such as barriers, pumps, and drainage systems, to protect your home. These measures can reduce the risk of damage and may also lower your insurance premiums.

Maintain your property: Regular maintenance, such as clearing gutters and ensuring proper drainage, can help prevent flooding. Keeping your property in good condition can also make it more attractive to insurers.

Review your insurance policy: Make sure your insurance policy provides adequate coverage for flood damage. If necessary, consider purchasing additional coverage to protect your home and contents.

How to find home cover

If your home floods, you could spend around nine months uprooted on average. So having the right cover is crucial. By talking to a specialist insurance broker, such as Howden Insurance, the process should be much smoother than having to search around and compare quotes yourself.

Plus, with our insurance expertise, one of our friendly branch advisors can can help you with the information insurers will want to know and find you the right advice and guidance for specialist cover. Essentially, at Howden we do the heavy lifting for you!

Find your nearest Howden Insurance branch, and speak to our team in person or over the phone.

Sources: BBC News, Environment Agency, Yahoo News.

You could also read:

- When will car insurance premiums go down?

- UK Customer service at all-time low!

- Watchdog: ‘Increasing number of home insurance claims rejected’

- Are you prepared for extreme weather?

- Your home fire safety checklist

This is a marketing blog by Howden Insurance.