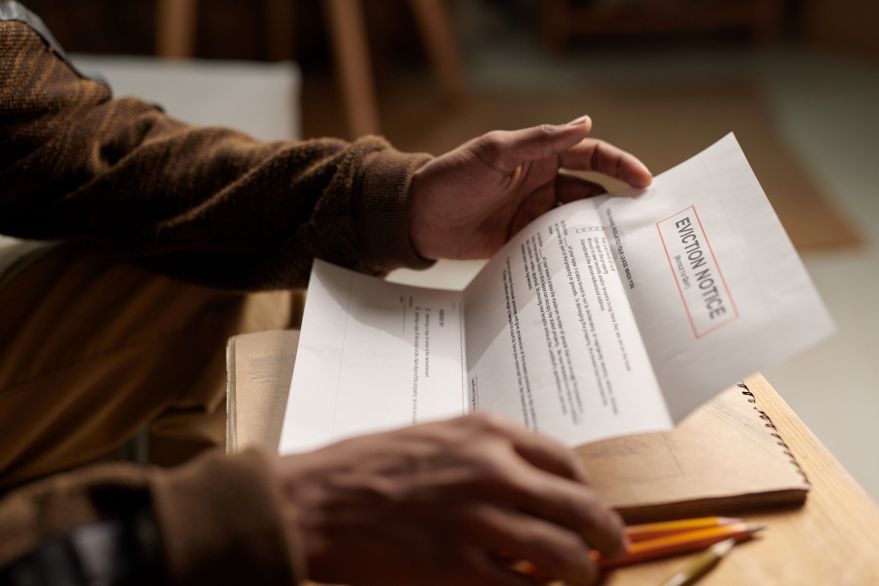

With the Renters’ Rights Bill on the horizon, big changes are coming to the private rental sector – and landlords are gearing up for a more regulated and legally complex landscape. The proposed reforms promise stronger tenant protections and longer eviction processes, which could mean more time, more paperwork, and more challenges when it comes to resolving disputes.

As this shift approaches, having a solid insurance policy isn’t just smart; it’s essential.

We talked to Millie Andrews, our landlord insurance expert, and explore some of the biggest changes on the horizon and how to stay one step ahead in a sector that’s rapidly changing.

What’s changing?

Fixed term contracts could have no end

If the bill is enacted, tenancies will have no end date and will roll on monthly. This means that during the first 12 months of the tenancy you will not be able to move into or sell your property. As long as the tenant doesn’t breach any tenancy terms, they will have a 12-month protected period.

Section 21 no-fault evictions could be abolished

The proposed change would mean landlords would have to rely solely on Section 8 possession grounds, which means facing stricter evidence requirements and extended notice periods to recover arrears or address breaches.

That’s why it’s more important than ever to carefully consider who you take on as a tenant. Understanding a tenant’s requirements for tenancy length could help you make a decision.

Independent rent-challenge tribunal

In an effort to deter ‘backdoor evictions’ where tenants are unfairly priced out of a property, one key reform would mean that tenants can contest rent rises above market levels.

This would trigger a formal appeals process that landlords must navigate to secure the return on their property. Landlords will still be able to increase rents, but only in line with market rates.

Stronger retaliatory eviction safeguards

The new rules would give tenants extra time to find somewhere else to live and they also require landlords to follow specific pre-action steps before starting possession proceedings. Failure to comply could mean your possession claim is delayed or derailed entirely.

Enhanced enforcement powers and penalties

Local councils could be given more power to step in – to carry out broader inspections, crack down on procedural slip-ups, and hit landlords with steeper fines under the updated Housing Act rules.

Tighter procedural obligations

With the new bill, landlords need to be meticulous: keeping detailed records, using the correct notice formats, and sticking to strict timelines. Miss a step, and you could be facing civil penalties or even criminal sanctions.

How can insurance help?

Rent guarantee and rent arrears protection both help when a tenant stops paying rent, but the way they’re offered can make a big difference.

Rent arrears cover

Rent arrears cover that’s included in a Legal Expenses Policy gives landlords more than just lost income back, with policies also including help with rent recovery when a tenant payment is overdue one month or more, evictions, legal advice, and support for tenancy disputes. It’s a more complete package that protects landlords through the whole process, not just the financial side, and often costs less than buying separate policies.

Rent guarantee cover

This is a standalone cover option, often offered by estate agents. It will provide you with the rental income you’d normally get from a tenant but doesn’t cover the legal costs of evicting the tenant.

So, in the long run, as you wouldn’t be able to recover your legal costs in the same way as you could with rent arrears cover, you could find yourself out of pocket!

What does a Legal Expenses Policy usually cover?

- Advice lines, such as tax advice, legal advice, online document drafting and counselling, so you can make the most of the policy, without even having to claim, and get ahead of any issues quickly and professionally.

- Legal defence against criminal prosecutions against you as a landlord.

- Eviction proceedings support, from serving Section 8 notices to eviction of squatters.

- Contract disputes support over buying or hiring in of any goods or services in relation to your property.

- Tax protection should HMRC examine your self-assessment tax return.

Key reasons to act before the bill

As we mentioned earlier, there is no confirmed start date for these reforms – yet. To avoid being stung, it’s crucial you act now.

Often, pre-existing and ongoing legal disputes are excluded from the policy, meaning that it is vital for landlords to take cover out proactively, prior to any disputes arising. With the Renters’ Rights Bill set to eliminate Section 21 no-fault evictions and shifting every claim onto Section 8’s stricter evidential requirements, extended notice periods and brand-new statutory grounds, having live cover means expert guidance is available the moment you need it.

It’s likely that stronger tenant safeguards could slow down possession claims and escalate costs, but a comprehensive policy locks the cost to you for advice lines, document drafting and legal defence.

By combining rent arrears cover with your legal expenses’ protection, you not only recover lost income after just one missed payment but also finance eviction proceedings and rent recovery, preserving your cash flow and future-proofing your portfolio against the turbulence of tomorrow’s rental landscape.

How a broker can help!

While the Renters’ Rights Bill is still making its way through Parliament, many of these reforms could be fast-tracked as part of the Autumn Budget. That means landlords may have less time than expected to prepare. And once the changes are in force, it may be too late to secure the protection you need.

At Howden Insurance, we have specialist landlord insurance experts on our team. They understand the legal landscape and can help tailor your insurance portfolio to meet the challenges ahead. Whether it’s rent arrears protection, legal expenses cover, or guidance on navigating possession claims, we’re here to help you stay compliant, confident, and covered.

Need a hand navigating the right cover? Find out more about Howden, or simply contact our experts directly on 01993 221922.

Sources: GOV.uk, Savills

You could also read:

- Hidden risks in your garden

- Can you be insured for ‘travel anxiety’?

- Home improvements that don’t need planning permission

- Are you a target for ‘crash for cash’ scammers?

- Cyberattacks: how to protect your data

This is a marketing blog by Howden Insurance.