Did you buy a new van last year? If so, you’re not alone – in fact far from it! A whopping 351,834 new ‘light commercial vehicles’ AKA vans were registered in 2024, an increase of 3% from the year before.

We know how important your van is to your trade – whichever model you choose not only has an upfront cost, but will affect your insurance premiums, petrol costs, and need ongoing maintenance. Beyond that, your van gets you from job to job, serves as a makeshift breakroom, and at times, is an office on wheels! The van you choose to support your business makes a big difference.

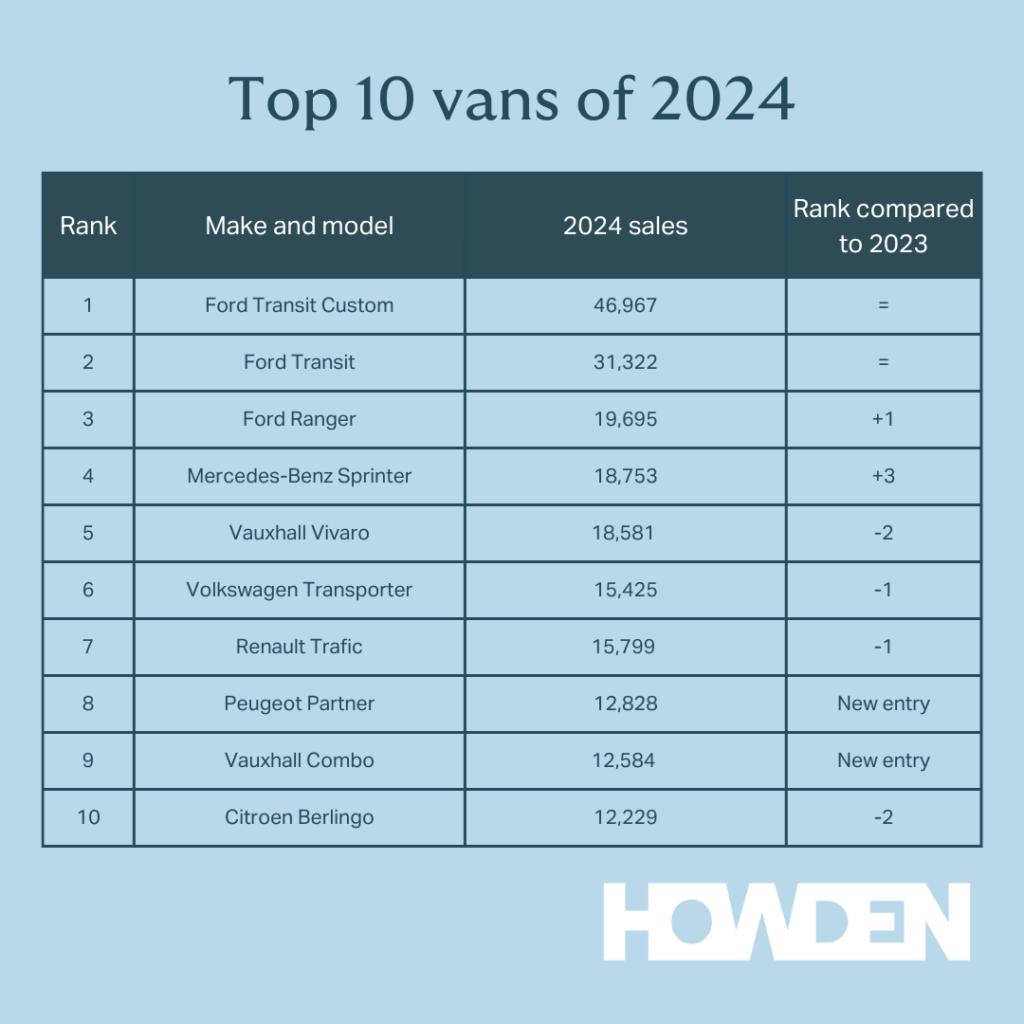

So, what was the overall consensus on 2024’s best vans?

And the winners are…

The best-selling van last year by a mile was the Ford Transit Custom, with 46,967 new registrations. This model is no stranger to the top vehicle sales charts, and classed as a medium size, it’s a great middle ground option from Ford.

At the smaller end of the spectrum, the most popular compact van for 2024 was the Peugeot Partner, which was delivered to12,828 customers.

Here’s the top 10 list of best-selling vans of 2024 in full:

While the new Ford Transit Custom only went on sale in late 2023, it’s very much business as usual, taking up where the old model left off at the top of the charts. This all-new model is a considerable improvement over all of its rivals and its predecessor, according to experts, earning the title ‘2024 Parkers Commercial Vehicle of the Year’.

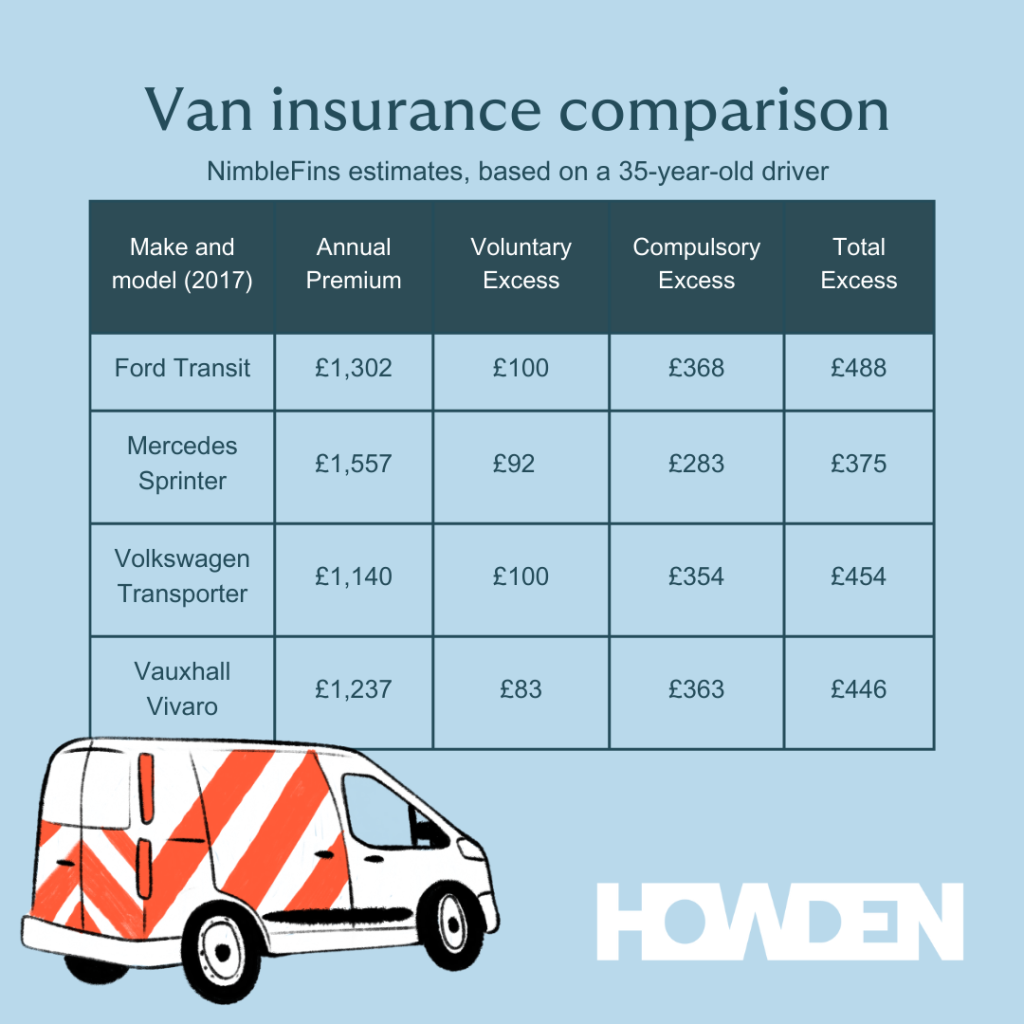

How much is the Ford Transit Custom to insure?

The latest stats show that quoted van insurance premiums have risen by 6.9% in the past 12 months and by 1.2% in the past three months. Van drivers most commonly received quotes between £500 and £749 or between £750 and £999.

Bear in mind that your van insurance can vary massively depending on your age. Quoted premiums rose the most for those aged 25 to 49, increasing by 8.4% in the year to the end of November. The over-50s experienced increases of 4.7% over the same period, while under-25s saw quoted premiums rise by 1.1%.

But only 6% of under-25s could source a quote from Price Comparison Websites for less than £750 in November. However, 40% were able to find a quote for less than £1,500, an improvement compared to 33% a year earlier.

Engine size, wheel placement and vehicle value are all things that can affect the price of your premium, so pay attention to the model if you’re thinking of buying a van. And a more expensive version of each model of van would increase your insurance cost. But, to give you a rough idea, these figures are based on the most popular version of each model.

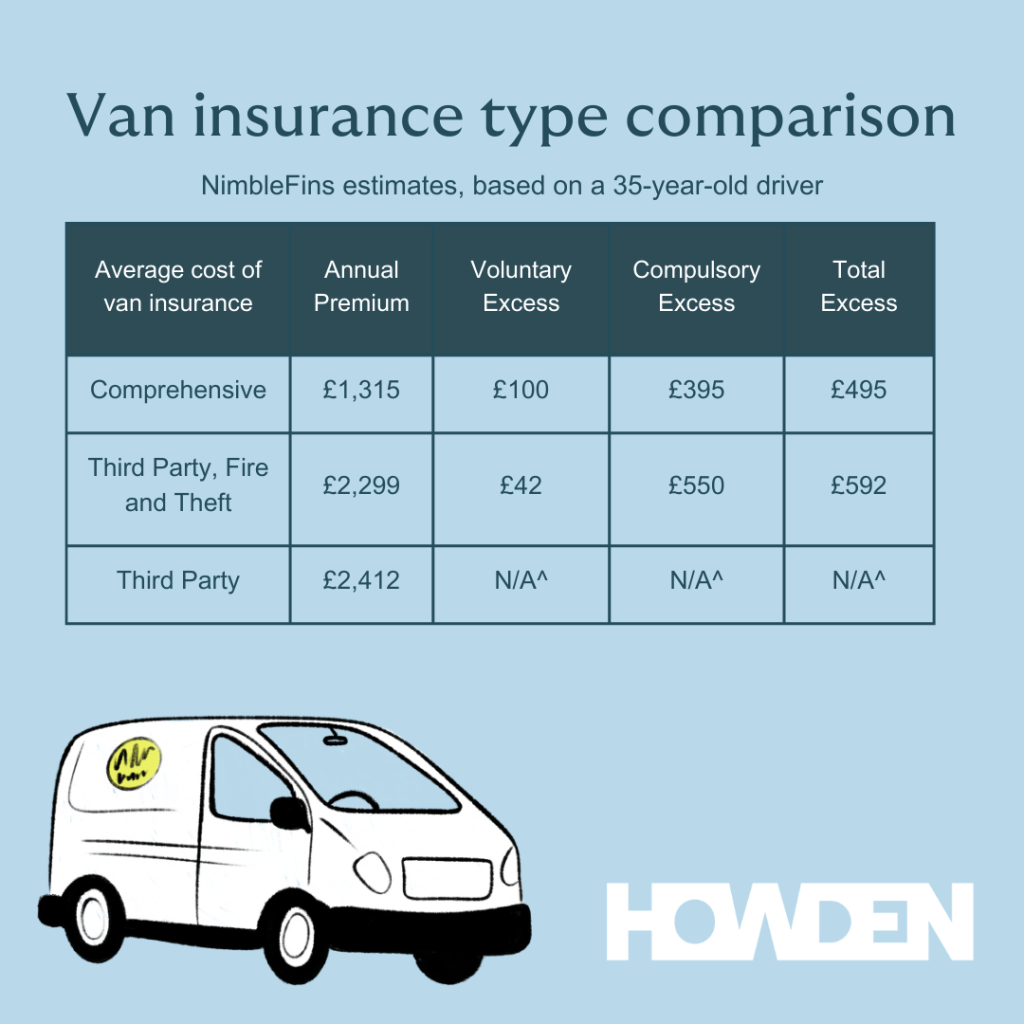

What level of van cover to choose?

As well as picking the right type of policy for your van and business (hire & reward, modified van etc.), you can also choose the level of cover.

Third Party Only – compensates other people (aka third parties) for any damage you cause to them or their property. It doesn’t cover the cost of repairs to your own van. It’s the minimum level of cover required by law.

Third Party, Fire and Theft – includes the above, and will also cover you if your van is stolen or damaged by fire.

Comprehensive – the highest level of cover you can choose, include third party, fire and theft, but also the cost of repairing or replacing your van in case of an accident, even if it’s considered your fault.

Research shows that comprehensive plans, came out, on average cheaper than the other two types:

While this may seem surprising at first – why would the best coverage be cheaper than van insurance offering less coverage?, it comes down to real-world experience of van insurers. They have found that higher-risk drivers tend to favour third party policies, and as a result, motorists taking out third party policies tend to have higher odds of a claim because they are riskier drivers. Therefore insurers charge more for these policies.

Value for money van insurance

Whether you’re a window cleaner, run a delivery business or have just picked up a part-time job that requires a van, our business van policies can offer exactly what you need to ensure you’re properly covered.

Speak to a member of our specialist team today and find out more about how we can support you and your business.

Sources: Parkers, NimbleFins, Auto Express, Society of Motor Manufacturers and Traders

You could also read:

- Trade – are you coping with the cost-of-driving crisis?

- Your van’s essential vitamins this winter!

- When will car insurance premiums go down?

- UK Customer service at all-time low!

- Watchdog: ‘Increasing number of home insurance claims rejected’

This is a marketing blog by Howden Insurance.