Here at Howden we want to help you stay savvy about scammers and often update you with the latest scamming techniques, or even remind you of some golden oldies to keep an eye out for. As we’re all on the look out for a good bargain, trying to save a few pennies on something essential or not-so-essential, it’s important you know the red flags.

Scammers are always on the prowl, ready to raid your bank account if you give them the opportunity to do so.

“Scammers know that we are distracted by the New Year coming in, budgets and inflation, and getting organised for the year ahead, which is great for them.” Francis West, CEO and cyber expert from Security Everywhere advises.

“We’re all so busy that our guard is down – and that is the time that the scammers strike!”

“So, if you think ‘this will never happen to me’, we must urge you to please, please think again because these scammers are organised criminals looking for easy targets. You need to be really vigilant. Remember – if it’s too good to be true, it usually is!”

Action Fraud revealed recently that online shoppers across England, Wales and Northern Ireland were scammed out of £15.3m between November 2021 and January 2022. On average, during that period, victims of online shopping scams each lost £1,000.

Jump forward to 2023 statistics. Reports via Finder now confirm that there were 71,894 reports of online shopping scams in the year to October 2023, with reported losses of £106.8 million, made to the police. The average person lost £1,486 per online shopping scam, based on those instances reported to the police.

Weird websites

Fake shopping sites are an incredibly common scam, with examples of ‘Etsy-craft’ designed to look just like Etsy, except you won’t get a handmade craft in return for your money, and an authentic looking Pandora site selling fake jewellery at a fake 70% discount. You really do have to be savvy.

It’s not like any of us go looking for these sites. However, scammers are looking for us, and are actively sending out phishing emails, publishing false websites, or advertising fake discounts or voucher codes to draw you in.

If you receive any anonymous discounts – ones where you will need to click a link – play it safe and delete the text, message, or email. Avoid purchasing anything from a Facebook or Instagram link. Also, use a reputable anti-virus product on your laptop, make sure its regularly updated and always turned on.

Before your inspection, ask for the registration number and check the details match up on the DVLA’s vehicle enquiry service. During your inspection, as well as checking the mechanics are working, ask to see the seller’s vehicle logbook (V5C). This is required when a vehicle is sold, so legitimate sellers should have it.

Vehicle scammers

Buying a car can often be complicated, let alone the prospect of being scammed. But fake vehicle listings are all over the internet – and on the rise. Lloyds Banking Group estimates vehicle scams were up by 74% in the first half of 2023 compared to 2022, with victims losing £998 on average.

Most car-buying scams start on Facebook (including Marketplace), Instagram and eBay, with the Ford Fiesta used most in these listings. Audis and BMWs are also popular with scammers, as are vans, with many on the look out for cheap models to convert into campervans.

So, how can you avoid a vehicle scam? Firstly, never ever part with your money without seeing the vehicle in-person and inspecting it. Fraudsters may use pressure tactics, like telling you there’s lots of interest or that you must buy before a certain time. But take your time and keep a cool head.

Social media scams

Another way scammers lure you to a fake website is via social media. An advert for a lovely gift idea appears in your feed, from a lovely small business who are also going to support a charity, or a larger company, maybe even one you know, and has the exact rare item you’ve been looking, for half the price! Don’t do it.

Two-thirds – that’s a whopping 68% – of all online purchase scams in the UK start on Facebook and Instagram!

Social media scams are a huge problem! Data from Barclays showed that people aged 21 – 30 are the most likely to fall victim, although all age groups are vulnerable.

Don’t click and buy on social media links, instead Google the business name and check out any reviews and whether there is a customer service telephone number. If you are unsure, don’t use them.

Copycat couriers

We’ve all known about this one for years – but let’s remind ourselves of the ways in which this can work, usually digitally (text, emails, WhatsApp and so on), or even via telephone.

- You’ve underpaid Royal Mail for a delivery so ‘click this link’ and pay now.

- We have not been able to deliver your parcel. It will cost £2 to rearrange delivery, ‘pay here’.

- We can’t deliver your item as you need to pay customs duty, ‘click to pay here’.

You make the payment, and receive a call from someone pretending to be from your bank, telling you an unauthorised payment has been made and urging you to send your money to a new account to keep it safe from scammers.

All of the above are scams. If in doubt, find the official providers telephone number online and give them a call directly to check.

How can you beat the scammers?

With all these scams, tricks and fraudsters out there, how can you keep yourself safe online, free to shop in peace? Here’s a few handy tips.

Always pay securely

When shopping online, use a credit card if you have one. Most major credit card providers protect online purchases and are obliged to refund you in certain circumstances. Using a credit card (rather than a debit card) also means that if your payment details are stolen, your main bank account won’t be directly affected. Also consider using a payment platform, such as PayPal, Google or Apple Pay. And whenever you pay, look for the closed padlock in the web address bar – it means your connection is secure.

Don’t overshare on social media

Unless you have set up your privacy, scammers are able to view anyone’s pages on Facebook, Twitter, Instagram, TikTok and more, so be wary about what you share.

It’s amazing what can be pieced together by scrolling through someone’s feed – where the person lives, maybe even a photograph of their home or car, a link to where they work, even email address – and of course, for the more visually orientated, your beautiful collection of Christmas gifts you’ve been so lucky to receive.

Some still post that they are going away, publicly declaring that they are leaving their home unattended. If this is you, you need to lock down your privacy on your social media channels now!

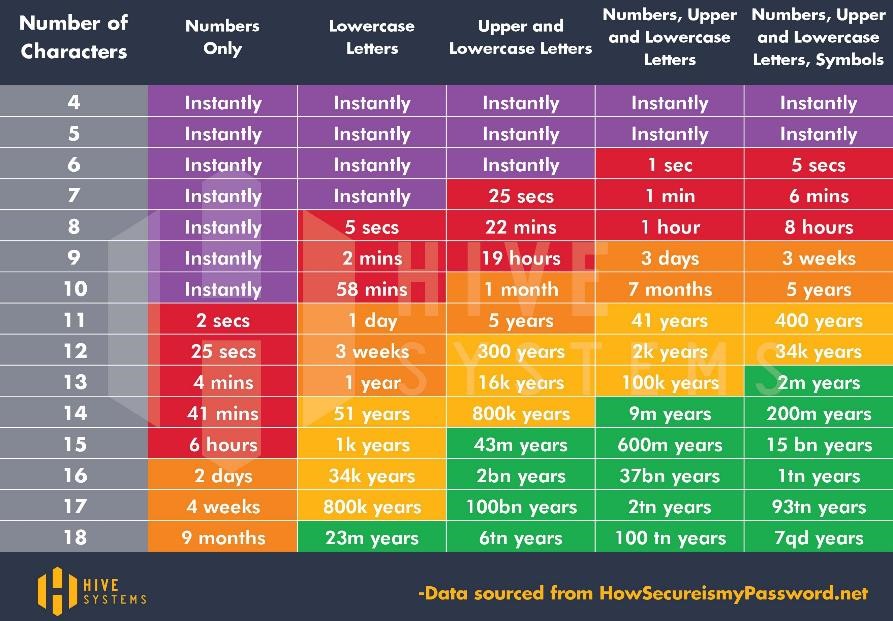

Get password protected

Now is the time to update your passwords. If a scammer can access one of your devices with an easily discoverable password, chances are you use that password elsewhere, giving them the key to your digital kingdom.

Also as important is to ensure that, if your children or grandchildren are given technology gifts that require a password for the first time, whether their first mobile phone, laptop or even a new camera, you teach them good password habits from the outset:

- Change any default passwords and usernames straight away!

- Choose complex passwords,

- Use a different password for each device

- Don’t write the passwords down or store them on your web browser

- Don’t share passwords with friends

- Don’t share any information with people not in the real world

- Don’t click on links in emails and SMS from people you don’t know – or if a link looks ‘weird’.

Not sure what your home contents or car insurance covers? Your local team will happily help. Simply pop into branch or give our friendly team a call.

Sources: TrendMicro, Security Everywhere, Barclays, Which?, Lloyds, Finder.com.