Consumer watchdog Which? has called out home insurers with a claims acceptance rate of less than 55%. They looked at Financial Conduct Authority data on home insurance claims over two years and found that two out of three Lloyd’s Insurance Group buildings-only claimants had their claims rejected.

The most common reason for turning down claims is when there’s no cover in the policy for additional accidental damage, or storm damage to gates and fences.

Now, imagine if you’re dealing with the aftermath of damage to your home – perhaps a result of flooding, fire or storms – and the significant stressors that places on you and those you care about. At that point, you’d assume that the home insurance you paid for would be there to support you. However, that is sadly, not always the case.

Statistics show home insurers are among the most likely to reject claims and to receive complaints from claimants. They also suggest the situation is getting worse.

How many home insurance claims are being rejected?

Let’s dive into some extraordinary statistics.

Of all the claims Lloyd’s received during that time, 15% to 20% led to complaints. Esure and Rentokil also got a thumbs down from Which? for having a claims acceptance rate of 40% to 45% for buildings-only cover. Esure had a complaints rate of 10% to 15%, while Rentokil’s was up to 5%.

AA and EUI (better known as Admiral) had a claims acceptance rate of 50% to 55% for buildings-only products. Urban Jungle’s acceptance rate for combined buildings and contents cover was 50% to 55%, with a complaints rate of 10% to 15%. For AA, 25% to 30% of all claims resulted in a complaint, while for EUI, it was 15% to 20%.

The FCA data also showed that claims acceptance rates for at least half of the firms offering buildings-only or combined buildings and contents policies got worse between 2022 and 2023.

For home insurance (combined buildings and contents policies), the overall percentage of claims accepted in 2023 was 72%, down from 76% in 2022. For contents-only home insurance cover, the percentage of claims accepted in 2023 was 77%, slightly more than the 76% in 2022. For buildings-only cover, the percentage of claims accepted in 2023 was 63%, down from 67% the year before.

Rocio Concha, director of policy and advocacy at Which?, said the claims stats show that too many home insurance customers are being let down by their cover. Whether claims are rejected because of unfair decisions or because customers don’t understand what they’re covered for.

“When home insurance customers take out a policy, they don’t expect to have to claim, let alone face a drawn-out ordeal with their insurer just to get justice. That customers who’ve been through tough times, like a house fire, face long battles with their insurer just to have their claim accepted is extremely concerning.

“The FCA’s requirements on insurers have been clear for some time: firms must deliver good outcomes for customers, especially those in vulnerable circumstances. Our research suggests that some firms aren’t following these requirements, and the regulator shouldn’t hesitate to take action against those falling short.”

Under – and overinsurance – is an ongoing issue

Our homes are our biggest asset, and require the best in protection. With the worsening weather and increase in the number of storms in the UK, ensuring a home is correctly and fully insured, with an accurate rebuild value taking onboard the increase in property values and costs of rebuild, is imperative.

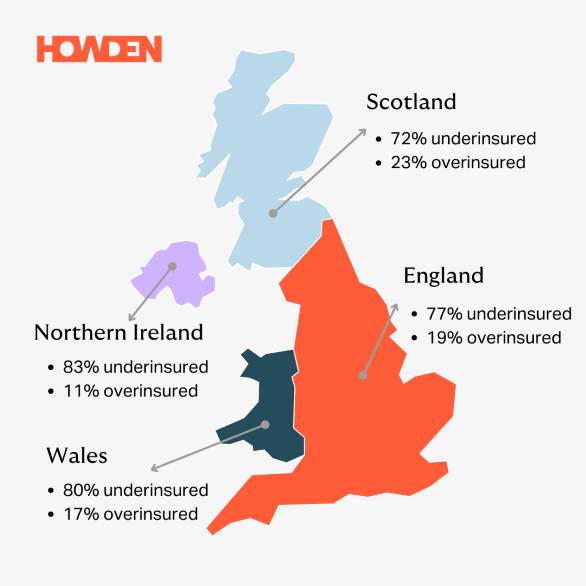

RebuildCostASSESSMENT.com’s 2024 infographic reveals that 76% of UK buildings are still underinsured. This percentage has fallen from 81% in 2023 and from an all-time high of 83% recorded in 2022, but there is still work to be done.

And, despite the drop, properties found to be underinsured are, on average, still only covered for 63% of the amount they should be. This matches last year’s findings, which were the worst on record.

What’s almost as shocking is the high percentage of properties overinsured, at around 20%, meaning that home owners are wasting their hard earned when they don’t need to. Obtaining the right advice has never been more critical.

Put your home in the best hands

Here at Howden, we’re passionate about ensuring our clients walk away feeling completely reassured by our expertise in what they need, and what they don’t.

Trying to cut corners and pay for the wrong level of cover, or opting for an insurer with a high level of customer complaints could be far more costly should the worst happen! For your own peace of mind, it’s important to speak to a broker in the first instance – ideally in person or over the phone. Another plus point for using a broker like Howden, is the support available during the event of a claim, and that is something that needs to be a deciding factor given recent claim – and poor customer service – statistics.

Would you like us to review your home cover? Pop into your local branch or give us a call, we’d be happy to check whether your home is in safe hands.

Source: Which?, Rebuildcostassessment.com

This is a marketing blog by Howden.