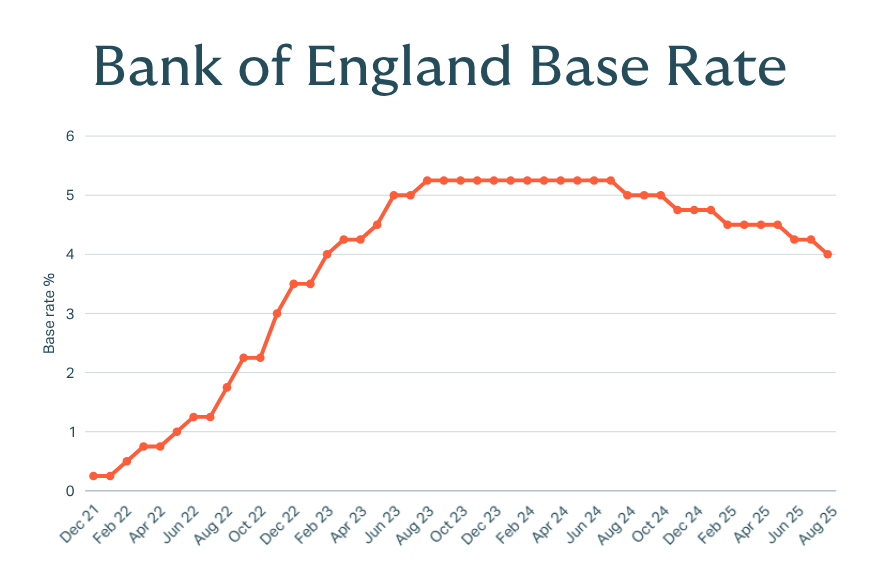

You may have seen the headlines today: the Bank of England has cut interest rates to 4%.

But what does that actually mean for your money, your mortgage, and your next financial move? Whether you’re a homeowner, a first-time buyer, or just trying to make sense of the economy, here’s what you need to know.

What’s the news?

The Bank of England’s Monetary Policy Committee (MPC) voted—by a narrow margin of five to four—to reduce the base rate by 0.25 percentage points, bringing it down to 4%.

This marks the fifth cut in a year and takes the cost of borrowing to its lowest level in more than two years.

The Committee noted that while inflation ticked up to 3.6% in June and is expected to hit 4% in September, it should fall back toward the 2% target over time. They’re keeping a close eye on wage growth and how it might affect consumer prices.

Is this good news for homeowners?

In short: yes, but with caveats.

If you’re on a tracker mortgage, which follows the Bank’s base rate, you could see an immediate drop in your monthly repayments. Around 600,000 people in the UK have one of these loans, and for them, today’s cut could mean real savings.

For example, on a £250,000 standard variable rate mortgage over 25 years, repayments could fall by around £40 a month, according to Moneyfacts.

If you’re coming to the end of a fixed-rate deal, you’re probably already watching the market closely. The good news? Lenders tend to price in expected rate changes ahead of time, so today’s cut may already be reflected in the deals currently available.

And it’s not just about rates – lenders are also adjusting their criteria. Some are increasing loan-to-income caps and lowering income requirements, which could make borrowing more accessible.

Remortgaging is on the rise

The latest data shows a 34% jump in broker searches for remortgage products in Q1 2025 compared to Q4 2024. That’s likely driven by the 1.8 million fixed-rate mortgage deals set to mature this year.

With so many people coming off ultra-low rates, it’s a nerve-wracking time. Today’s cut offers a bit of relief – and a reminder to start planning ahead.

Commenting on the decision, Mark Harris, chief executive of SPF Private Clients, says:

“The fifth quarter-point reduction in a year comes to no surprise and points to a slow and steady pattern in reductions as the Bank wants to be certain that inflation is under control before it takes more drastic action.

However, while the Bank is tasked with keeping inflation at 2 per cent, there is an argument that lower interest rates are needed to stimulate the flagging economy.

“A bolder, half-point reduction would have been welcome, sending out a strong message and helping boost the housing market and wider economy, particularly as the stamp duty concession has now ended.

“Swap rates continue on a downwards path with lenders reducing mortgage rates in recent weeks. This latest rate reduction was largely expected and has been factored into pricing already. However, it’s not just pricing that is improving as lenders are also broadening policy, including increasing loan-to-income caps and lowering some income requirements, which is boosting affordability.”

What should you do next?

If you’re thinking about buying, refinancing, or just want to understand your options, now’s a great time to speak with a whole-of-market broker like SPF Private Clients.

You can often lock in rates months in advance, giving you peace of mind. And if rates drop further before your mortgage starts, you may be able to switch to a better deal.

Want to chat through your options? Reach out to one of our advisers—we’re here to help you make sense of the numbers and find a deal that works for you.

Sources: BBC News, Money Facts

You could also read:

- Hidden risks in your garden

- Can you be insured for ‘travel anxiety’?

- Home improvements that don’t need planning permission

- Are you a target for ‘crash for cash’ scammers?

- Cyberattacks: how to protect your data

This is a marketing blog by Howden Insurance.