Are you looking for a mortgage or loan? If so, your lender could ask to see your SA302. But what is it? And how do you go about getting one?

Here, we’ll look at everything you need to know about the information in an SA302 form. And we’ll explain how it’s used by lenders, and how you can access it yourself.

- What is an SA302?

- What does a SA302 look like?

- How do I get a SA302 form?

- How do I get my SA302 tax calculation?

- Recap

What is an SA302?

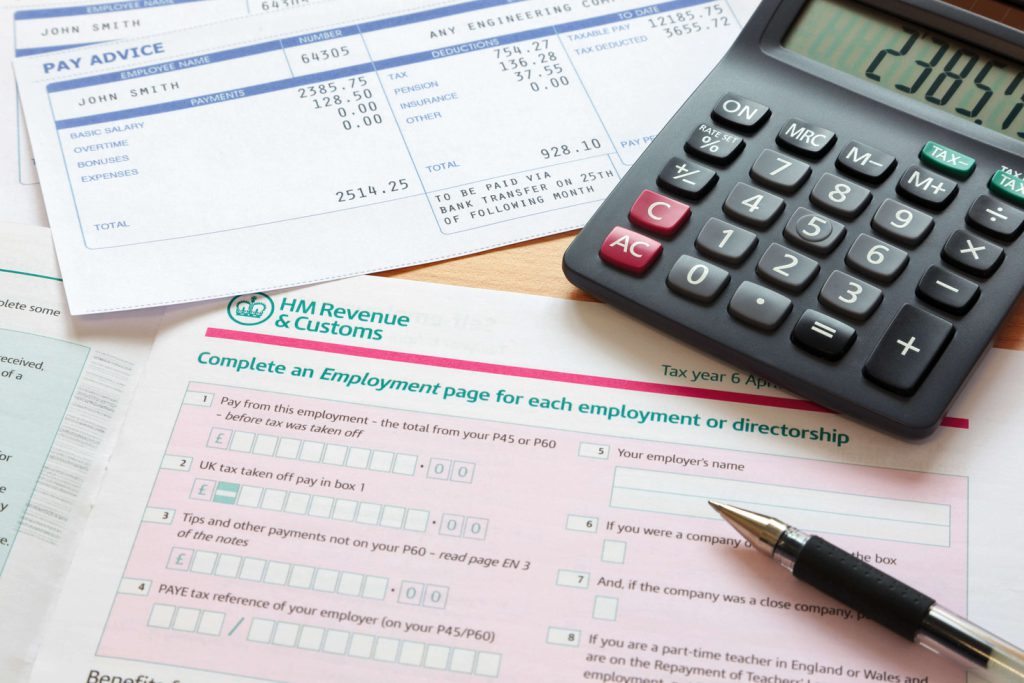

An SA302 is a form from HMRC that sets out your own tax calculation. It can cover up to four years of earnings and income tax. And, unlike PAYE documents like your P60, it covers income from all sources.

That makes it an important document for lenders because they can see a full picture of your income. That means it gives them a far better sense of your ability to repay a loan.

It’s particularly important for self-employed people or those who receive income from a range of sources. Your SA302 will cover:

- Any salary you receive from an employer

- Any profits from self-employment

- Any profits you make from land or property you own in the UK

- Any dividends you receive from companies in which you have shares

- Any income from UK pensions or benefits

What does a SA302 look like?

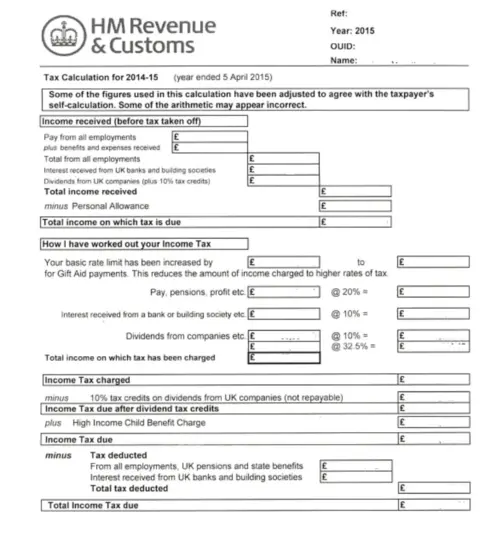

An SA302 is divided into a number of different sections. At the top, it will show the period covered. That can be a single tax year or up to four years. (Note that the tax year in the UK runs from 6 April to the following 5 April.)

It will also have your name and your Unique Taxpayer Reference (UTR). This is a 10-digit number that’s generated when you first register for self assessment of tax. As the name suggests, it’s unique to you — so there’s no danger of your information being confused with anyone else’s.

The SA302 will then set out your gross income. This is the amount you receive before any tax or other deductions. Each type of income will be listed separately, and then added together to give a total.

Next, it sets out your personal allowance. That’s the amount you can receive before you pay any income tax. The personal allowance is then deducted from the total income to show the amount of income on which tax is due.

Different types of income are subject to different rates of tax. So each form of income is listed separately, with the rates of tax that apply set out alongside it. The form then shows the calculation to identify how much tax is payable for each category of income.

The next section adds up all the tax that’s due for your total income. If you’ve been wondering, “What are tax calculations?” this is it! And you can see exactly how it’s done, step by step, on your SA302.

Finally, the form will set out when the tax is payable. This might include a deduction for any tax you’ve paid in advance — known as paying “on account”. But it may also include a payment on account for tax that’s expected to fall due the following year.

You can check your self assessment returns statement of account at any time using the HMRC portal. That will tell you how much tax you’ve paid in advance, how much is due, and when you need to pay it. To do that:

- Sign into your HMRC online account (you’ll need your Government Gateway ID, password and UTR)

- Choose the option to view your latest self assessment tax return

- Select the option to “View statements”

3 ways you can get a SA302 form

By now, you probably want to know how to get an SA302. The answer to that depends on how you submitted your tax return.

If you’ve been asked for your SA302 by a lender or broker, it’s also important to check what format they’ll accept. Some are happy to receive documents that you’ve printed out. Others won’t (in which case, it can be much harder to find a way to get them the information).

HMRC have provided a comprehensive list of lenders and mortgage providers who will accept printed tax summaries. You can find it here.

There are three main options to get hold of your SA302:

- If you’ve completed your self-assessment online, you’ll be able to download it through the HMRC portal.

- If you or your accountant use commercial software to submit your tax return, that software will also allow you to print your SA302.

- If you’ve used a paper form to complete your self-assessment, you can phone HMRC and ask them to send you your SA302.

Getting your SA302 via HMRC online

You’ll need to wait 72 hours after you’ve submitted your tax return online to get your SA302 via the HMRC portal. But it’s a very easy process. Here’s what to do.

- Sign in to HMRC Online Services. You’ll need your Government Gateway User ID, password and UTR.

- Click on the button that reads “More self assessment details”.

- Select the option to “Get your SA302 tax collection”. This will open up the document.

- At the top of the page, there’ll be a button to “Print your full calculation”.

You can also get your tax calculation for previous years via this route. Just go to the menu and select “Tax return options”. You’ll then be able to choose the year for which you want your calculation.

Getting your SA302 from commercial accountancy software

Different software packages use different names for the SA302. You may see it referred to as your “tax computation”, for example. You’ll usually be able to access it through the dashboard that breaks down your tax liability.

If you’ve used commercial software to submit your tax return, you’ll still be able to access a tax year overview via the HMRC portal. Skip ahead if you want to know how to do that.

Getting a paper copy of your SA302 from HMRC

If you’ve submitted your tax return on paper, HMRC will be able to send you a hard copy of your SA302. They’ll normally do this automatically after your tax return has been processed.

But if you’ve lost the document, or it’s gone astray, just give them a ring on 0300 200 3310. (If you find it difficult to use a telephone, there are a number of alternative ways to get in touch.) You’ll need your National Insurance number and UTR.

How do I get my SA302 tax calculation?

So, your lender or mortgage provider accepts an SA302 printed from your HMRC online account or commercial software. That’s great news. But they’ll probably also need what’s known as a “tax year overview”.

This is a document that verifies that the information in the SA302 is correct. You can also get this online through your HMRC personal account. The process is similar to the one for accessing your SA302, and you’ll need your Government Gateway ID, password and UTR.

Here’s what to do:

- Log into your HMRC personal account via the SA302 tax calculation on the GOV.uk website.

- Select “self assessment” (depending on your account, you may be directed to this page automatically)

- Click on the link to “View self assessment tax return” and select the year you want from the drop-down menu

- Click on “Go”

- Scroll down to the button that says “Print your tax year overview” and click on it

- You can also select “Save as PDF” to save the document to your computer

Recap: What is your SA302?

Your SA302 is simply a record of how much income you generate altogether and the tax you’ve paid on it. It can cover a single financial year or up to four years.

You can access it in a number of different ways, depending on how you’ve filed your tax return. Options include completing your self assessment tax return online via the HMRC portal, phoning HMRC, or downloading it through commercial accountancy software.

If you’re submitting it to mortgage lenders or providers, check if they’ll accept documents you’ve printed yourself. You’ll probably need to submit your tax year overview alongside your SA302 too.

Also read:

- Who pays the insurance on a company car?

- Your Simple Guide to Self-Employed National Insurance

- What is a P11D? (Complete Guide)

- What is a P60 in the UK? (Full Guide)

- Car Tax Checker – check your car is taxed

- MOT status checker