From home to car, to holiday insurance, yes, prices have risen. After COVID, political instability and the cost-of-living all hitting our income, most of us are already feeling the squeeze.

As if the cost-of-living wasn’t difficult enough, with rising mortgage rates, energy bills, and food prices, it seems car insurance is the latest household bill to soar, with some motorists having their bill rise by as much as 70% when their policy comes up for renewal.

We decided to investigate further: is this due to circumstance or profiteering? The answers may surprise you.

Shocked by the rise in your car insurance premium?

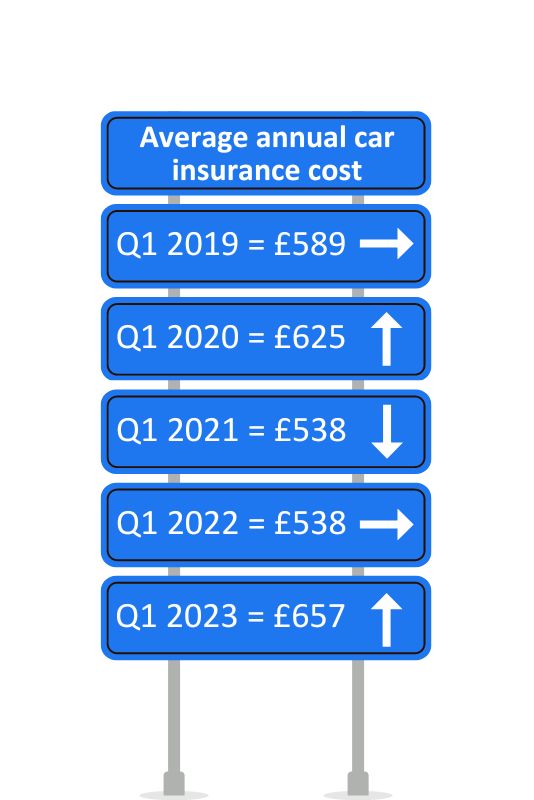

Though fuel prices have declined from the record highs in 2022, the cost of running a car overall is still higher than it was, with car insurance premiums up by 43% in the last 12 months. Here’s why:

Post-pandemic adjustments

The price of car insurance decreased each quarter in 2021, possibly as a result of changing driving habits during the pandemic. More people worked from home, meaning there were fewer vehicles on the road, fewer accidents, and less risk.

Now, there’s an increase in road traffic, leading to an increased risk of car insurance claims, which is reflected in the now higher premiums. Insurance brokers have added that the number of claims has also increased this year, forcing firms to increase prices.

Another effect of the pandemic is the value of second-hand cars. These have become more popular, leading to higher prices. But this also means they’ve become more expensive to insure.

Just look at how premiums have fluctuated over the last four years:

Energy costs and supply chain chaos

Another reason for increased car insurance premiums is attributed to the rise in energy costs. The Association of British Insurers (ABI) calculated that extra energy-related expenses mean the average cost of repair has gone up by £71.75 since the final quarter of 2022. This price hike has been driven by a 300% increase in energy bills for repairers, who didn’t qualify for government support and have instead been forced to absorb the full extent of the soaring energy costs.

Paint and material costs were also up by 16% in the last quarter of 2022, fuelled by the cost of transporting and manufacturing parts. The industry has also been hit by supply chain issues and shortages, making parts for repairs harder and more expensive to get hold of. The knock-on effect is reflected in higher car insurance premiums, with insurers taking these higher costs into account.

Insurance ‘loyalty penalty’ scrapped

Before January 2022, insurance companies often gave discounted rates to new customers, and loyal customers bore higher cost upon renewal, to balance out these pries. The Financial Conduct Authority (FCA) banned insurance companies from increasing prices for loyal customers, a practice known as the ‘loyalty penalty’.

Currently, insurers are only obliged to match an existing customer’s quote when a new customer applies for a directly comparable policy through the same channel.

Did you know that, if you’re an existing customer and you renew automatically, you could be paying more than if you signed up for the same policy via a broker. On the bright side, you now know that you could enjoy a lower premium when it comes time to renew, by working with a broker like A-Plan.

Have home insurance premiums also gone through the roof?

Yes, unfortunately home insurance premiums have also been rising. During 2022, these premiums fell to a record low, due to competition and the ‘loyalty penalty’ described above being banned. But now, these prices are rising again.

The average premium for a combined buildings and contents policy was £315 in the first three months of 2023, up 6% on the same period in 2022. The average buildings-only policy cost £236 in the first quarter of this year, a rise of 5% on 2022. But what is causing these increases?

The impact of climate change on insurance

Let’s start with the unexpected first. You may not think it possible, but even climate change is playing a part in increased premiums.

Extreme weather has blighted our shores from Storms Arwyn and Barra in 2021 to Storms Malik and Corrie, followed by Dudley, Eunice and Franklin in 2022. Did you know that, according to ABI, storms Dudley, Eunice and Franklin in February 2021 saw 177,000 claims with insurers paying out nearly £500 million?

This is in addition to other storms and flooding events, wildfires during the UK’s hottest summer, and freezing weather in December. While the link to climate change may be a surprise, our changing weather has induced more claims activity than before.

Theft, fraud and accidental damage claims increase

It’s a difficult time, which can lead to an increase in claims. Most are legitimate claims, perhaps by those who wouldn’t normally use their insurance to claim for accidental damage, with higher claims being reported.

However, there is also a more sinister side to the increase in claims.

Bloomberg has also confirmed that shoplifting is up by 18%, while even the countryside is seeing an increase in vehicle, fuel and even livestock theft. Add to that, employee theft is up by 19% in just one year, according to Zurich.

The same 2022 report by Zurich also confirmed a 25% rise in insurance fraud. The most common claims involved high value jewellery mobile phones and TVs – with the average claim equating to £8,800 a day. As households and businesses come under financial strain, there is a natural increase in bogus claims, which has led to new systems being implemented and a strain on resources.

How does this affect your premiums? Claims across the board are up, as are the costs to replace or repair, which unfortunately means that premiums rise to accommodate these increased claims.

Yes, inflation has impacted the cost of insurance premiums too!

Stubborn inflation has translated to increased costs of repairs and replacements. The costs of materials have risen at an astonishing rate. For example, the cost of rebuilding or repairing a home has increased significantly with building materials costing 8.7% more in March 2023 than they did in 2022.

How can you keep your insurance premiums as low as possible?

While the outlook remains uncertain, there are some ways you could minimise the price shock:

- Speak to a broker. Brokers will help you find the right balance of making sure you are only covered for what you need, while avoiding costly underinsurance.

- Don’t simply renew with your existing provider – shop around! Your broker is here to help!

- Build up and protect your No Claims to get the best discounts.

- Combine policies to save, for example A-Plan allows clients to combine their car and home insurance to save £303, or £486 if you include van.*

Car insurance savings tips

- Consider raising your voluntary excess to reduce your premiums, however it’s also important to weigh this up with whether you could afford to pay the excess in the event of a claim.

- Check car insurance groups prior to buying – Group 1 is the cheapest to insurance, while Group 50 is the most expensive.

- ‘Modding’ your car could increase your insurance premiums so check with your insurer before you start – or speak to A-Plan as we have specialist teams who can help find you the correct cover without hurting your pocket. Whatever you do, don’t avoid telling your insurer, as you could find a claim is cancelled.

- Can you lower your mileage? The less you drive, the lower the risk of an accident, which can help keep premiums lower.

- Consider switching from Comprehensive to Third party – but be aware that this is not always a cheaper option.

- Be mindful that, although some insurers may sell what appears to be a cheaper policy, it could come without essential cover for windscreens and more.

Home insurance savings tips:

- Like car insurance, you can also raise your voluntary excess on your home insurance to reduce your premiums.

- Up your home security: burglar alarms, security lighting, CCTV, a safe and improving your locks can all help keep your insurance lower.

- Avoid over-insuring your home – while underinsurance remains an issue in the UK, over-insurance should also be avoided. This is something our experts can advise you on.

- Check your rebuild value – some underestimate it, while other overestimate it!

- If you live in a flood-risk area, protect your home from the outset, prior to any flood damage, to get a better deal.

Talk to an insurance broker!

With all this in mind, it is now more important than ever to make sure that, when it comes to renewing or obtaining new insurance, you don’t cut corners and opt for the cheapest deal which could leave you in more difficulty. You need to be 100% sure that you are getting what you are paying for, with no surprises.

That’s where our A-Plan branch colleagues can really help – so if you are concerned, or facing difficulties, your local branch team is on hand and available to help you. Give them a call or simply pop into your local branch for a chat.

Sources: Confused.com, Money Supermarket, Which?, The Guardian, iNews, Home Building & Renovation

You could also read:

- Which supermarket is REALLY the cheapest?

- What will reduce fuel consumption – 10 tips!

- The great mobile phone contract rip off!

- 5 Direct debits you didn’t know about!

- Car Insurance Groups [A Complete Guide]